Navigating the Future of Animal Health

At WittKieffer, we embrace the philosophy of “One Health,” which emphasizes the interconnected nature of animal wellbeing, human health, and environmental sustainability. Guided by this viewpoint, we conducted an in-depth analysis of leading animal health organizations to understand how they are evolving in the face of significant changes, driven by technological advancements and evolving global health perspectives.

Our research investigates the current state of leadership in the industry, exploring the challenges and opportunities faced by executives and delving into how companies adapt their leadership strategies to navigate the increasingly complex landscape. In addition, we examine the factors influencing the growth of the global animal health market and the potential implications for industry leadership.

Our aim is to provide comprehensive insight into the current state of leadership in animal health and the forces shaping its future, accompanied by actionable recommendations for industry executives to succeed in the face of change.

The Dynamic Animal Health Industry

The animal health industry is a dynamic and expanding sector with various intersecting growth factors and challenges, resulting in a level of complexity that requires comprehensive solutions. Employing the philosophy of “One Health,” our analysis of the animal health industry emphasizes the importance of collaboration, innovation, and responsible practices across the “One Health” spectrum.

Animal health refers to the scientific and medical fields that focus on maintaining and promoting animal health, wellbeing, and welfare. This includes a variety of technologies, products, practices, and services to prevent, diagnose, treat, and manage animal diseases, injuries, and other medical conditions in a wide range of animal species, such as companion animals, livestock, and wild animals. The main objective of animal health is to improve the quality of life for animals, encourage their longevity, prevent the spread of diseases, and — by extension — protect public health.

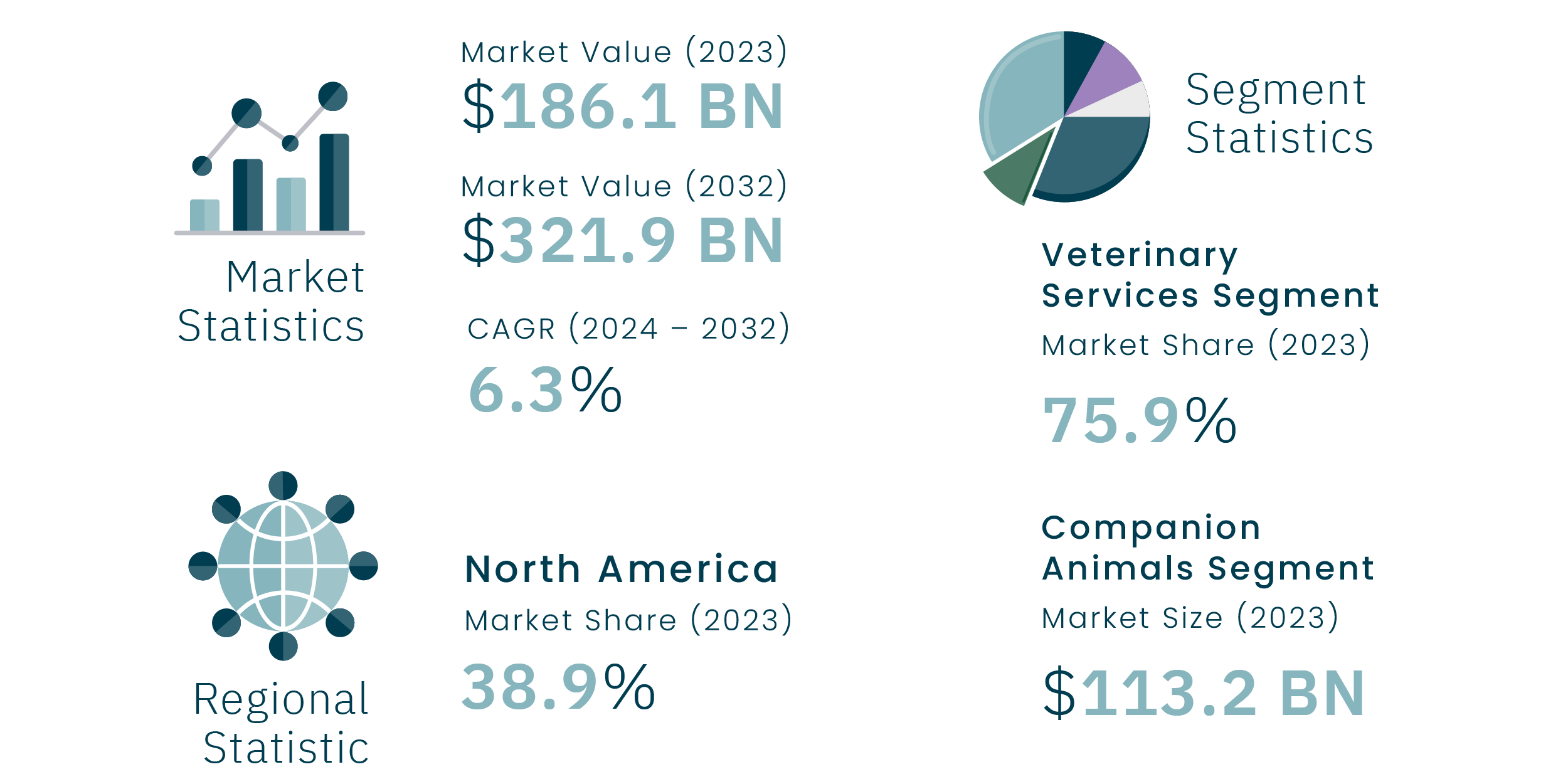

The global animal health market was valued at USD 186 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.3%, reaching USD 322 billion by 2032 (Global Market Insights, 2024). This growth rate is more than double the global economic growth forecast, which hovers around 3%, depending on the source and timeframe (International Monetary Fund, 2024; The Conference Board, 2023).

Accelerating Market Growth

Global animal health market growth is driven by several key factors.

Rising Pet Adoption and Humanization

Pet parenthood is on the rise worldwide, with an estimated 373 million cats and 471 million dogs kept as pets globally. In the United States, 87 million households — representing 66% of households nationwide — keep a pet, compared to 56% in 1988. Similarly, in Europe, approximately 91 million households, or 46%, adopt pets (World Animal Foundation, 2024). This trend will continue as pets are increasingly recognized as family members. As a result, there is growing demand for high-quality veterinary care, pet products, and services. In 2023, consumers in the United States spent a staggering USD 147 billion on their companions, reflecting the strong market growth in this sector — a CAGR of 10.2% over the last five years (American Pet Products Association, 2024).

Advancements in Veterinary Care

Advancements in veterinary care, including the development of new therapeutics, vaccines, and biopharmaceuticals, as well as innovations in gene therapy, stem cell therapy, immunotherapy, and genomics, are transforming animal health and wellbeing. Biotechnology advancements, such as recombinant DNA technology and vector-based vaccines, are enabling safer and more effective disease prevention in animals (PR Newswire, 2024). Some of these advancements, namely monoclonal antibodies, stem cells, genomics, and other cutting-edge treatments, previously only applied to human health. Additionally, increased awareness and education campaigns are promoting better health outcomes for animals and enhancing the quality of care in veterinary medicine.

Digital Technologies

Digital technologies, for instance artificial intelligence (AI) and advanced diagnostics, are also revolutionizing animal health and veterinary medicine. Millennials — the largest demographic group of pet parents in the United States, representing 32% of all pet parents (American Pet Products Association, 2024) — particularly appreciate the convenience and personalization these technologies offer. Real-time and remote monitoring technologies and wearable devices provide insights into animals’ health status, thereby enabling early detection, proactive intervention, and more personalized data-driven care. At the same time, at-home diagnostic tools and testing kits are on the rise, allowing pet parents to monitor their animals’ health from home (Unimrkt Healthcare, 2024). Furthermore, increased preventive diagnostics generate more data for drug development in clinical trials, leading to faster research and development processes and accelerated market launches.

Concerns Over Zoonotic Illnesses

Zoonotic illnesses, or infections that are spread between people and animals, pose a significant threat to public health and animal wellbeing. Examples of zoonotic diseases include rabies, Ebola, SARS, MERS, avian influenza, and COVID-19, among others. More than 60% of human pathogens are zoonotic in origin, and three out of every four new or emerging infectious diseases in humans come from animals (Centers for Disease Control and Prevention, 2024). This highlights the critical need for robust disease surveillance, prevention, and control measures. Collaboration between human and animal health professionals is critical to mitigate the risks associated with zoonotic diseases and ensure the health of both humans and animals.

Growing Demand for Animal Proteins and a Renewed Approach to Biosecurity

An increasing global population and rising income levels contribute to growing demand for animal proteins. By 2050, the global population is projected to reach nearly 10 billion, leading to a 56% increase in food demand (World Resources Institute, 2018). This growing demand puts pressure on the livestock industry to enhance productivity and efficiency, through the utilization of improved genetics, nutrition, husbandry, and performance-enhancing technologies. However, this intensification of animal production poses several challenges, including increased resource use, greenhouse gas emissions, and the risk of infectious diseases. A unified approach to responsible animal production emphasizes the importance of biosecurity, food safety, and environmental protection, ensuring sustainable farming practices.

Challenges in Animal Health

The animal health industry benefits from remarkable developments and strides in innovation and growth, yet ongoing challenges demand comprehensive solutions.

Productivity vs. Climate Change and Rising Food Costs

The livestock industry faces the challenge of maintaining productivity while addressing the impacts of climate change and rising food costs. Collaboration between various market participants, including farmers, veterinarians, policymakers, and environmental scientists, is essential to developing holistic and innovative solutions that balance productivity, environmentally sustainable farming practices, food safety approaches, and responsible animal production practices.

Antimicrobial Resistance

The overuse and misuse of antimicrobials in animal health contribute to the emergence of antimicrobial resistance, which poses a significant threat to both animal and human health. Collaboration between human and animal health professionals is critical to developing and implementing prudent antimicrobial use policies and strategies.

Health and Wellness in Companion Animals

Chronic diseases, infectious diseases, parasites, and behavioral issues are common health concerns in companion animals. A holistic view of companion animal health, encompassing nutritional balance, exercise, mental stimulation, and veterinary care, is necessary to their wellbeing and healthy aging.

Point-of-Care Providers

Veterinary clinics and hospitals face high burnout rates among veterinarians and practice inefficiencies. To improve standards of care and consumer experience, veterinary care providers should adopt technology for operations, patient care, and engagement, ensuring a personalized “continuum of care”. By embracing a technology-driven approach, these providers can streamline workflows, improve resource allocation, and foster a more supportive work environment, ultimately contributing to better health outcomes, enhanced pet parent satisfaction, and reduced veterinary burnout.

Enablers And Emerging Trends — What’s Next?

Uptake of Pet Insurance

The global pet insurance market was estimated at USD 11.9 billion in 2023 and is projected to grow at a CAGR of 14.2% from 2024 to 2030 (Grand View Research, 2023). In North America, the number of insured pets significantly increased, reaching 6.3 million in 2024, a 42.1% increase compared to 4.4 million insured pets in 2021 (North American Pet Health Insurance Association, 2024). However, despite this growth, the level of insurance coverage remains relatively low — in the United States, only 4% of pets are insured, and only 20% of employers offer pet insurance as a voluntary benefit (KPMG, 2024). Pet insurance plays a crucial role in facilitating access to quality veterinary care by helping offset the costs of medical treatments. Insured pets visit veterinarians two times more often than uninsured pets (KPMG, 2024), indicating a positive impact on preventive and critical care. Efforts to further increase pet insurance adoption are essential to improving the quality of life for pets and enhancing pet parent satisfaction.

Investments and Consolidation

In the animal health industry, mergers and acquisitions (M&A) and private equity (PE) investments are prevalent strategies for companies to expand market presence, diversify product offerings, and achieve economies of scale. Although M&A volume in animal health has seen a slight decrease in 2024 to date, PE firms ramped up their focus on add-on deals. From January to August 2024, PE add-ons in the animal health sector surged by 84.6% year-over-year, with 24 deals representing 40% of sector activity (Capstone Partners, 2024). PE firms are leveraging add-on transactions to gain market share in specific product categories, cater to increasing demand for new products, and expand their geographical footprint. Although deal volume experienced a slight decrease, deal value remained strong, with the total value of disclosed deals in the animal health sector remaining consistent with the previous three-year period: this represents an average of USD 288 million for the first eight months of 2024 compared to USD 285 million from 2020-2023 (Capstone Partners, 2024). The increase in add-on acquisitions and the robust deal values reflect growing investor confidence and set a positive stage for a rebound in M&A volume.

A holistic approach — bringing together diverse sub-sectors, organizations, and communities — fosters strong human-animal bonds, collaboration, and knowledge sharing. Furthermore, the “One Health” philosophy goes beyond individual treatments and technologies, addressing global challenges, such as antimicrobial resistance, zoonotic diseases, and climate change’s impact. Advancements in one area of animal health can have far-reaching benefits across the Quality of Life Ecosystem. For instance, innovations in livestock health management improve animal wellbeing, food safety, and security. Breakthroughs in companion animal medicine often translate to human health, showcasing the symbiotic relationship between veterinary and human medicine. Cross-sector collaboration and sustainable practices aim to build a healthier, more resilient world and improve quality of life for animals and their caretakers.

Exploring Leadership Trends In The Animal Health Industry

The animal health industry is experiencing extensive developments and fluctuations, meaning the market faces a distinct set of challenges and opportunities that demand transformative leadership. To make a positive impact on animal health and wellbeing, leaders must possess a deep understanding of the science and technology behind animal health advancements as well as the ability to forge robust partnerships with participants across the value chain, including farmers, veterinarians, policymakers, and environmental scientists.

Investing in leadership development and talent management is fundamental for animal health organizations to remain competitive and succeed in this dynamic and expanding industry. Our research suggests that executive leadership teams at animal health companies will benefit from acquiring and developing new skills and expertise to evolve and adapt in this changing landscape. Companies that fail to do so may struggle to meet the industry’s demands in the long run.

Leadership Team Composition

WittKieffer’s proprietary analysis of the executive leadership teams of 35 animal health companies reveals a predominantly traditional composition, with high turnover common across roles. Although some leadership teams encompass business leaders overseeing new and specialized functions, the overall composition reflects the presence of general managers and established functions in enterprise services. While such composition was effective historically, growth in demand and subsequent market expansion means that animal health companies should consider including roles conducive to growth (for example, business development and strategy) and the transformation needs of a changing business (for example, digital and AI).

Executive teams at animal health companies are built around leadership roles that we classify into four categories. Our analysis examines the educational and career backgrounds of leaders under each group, showing the unique demographic profiles and educational qualifications.

Chief Executive Officers

Serving as the guiding force of an organization, the Chief Executive Officer (CEO) plays a pivotal role in setting the strategic direction and vision for an animal health company. In terms of demographics, CEOs have an average age of 56 and remain heavily male-dominated: our sample contains just 14% female CEOs. In terms of educational background, 43% of CEOs hold an MBA, 9% hold a PhD, and 6% are qualified veterinarians.

Commercial Leaders

Comprising business unit or regional leaders, this group focuses on driving revenue growth, go-to-market strategies, and market expansion to ensure profitable business growth. The average age of this subset is 52 years, and this group also suffers from a lack of gender diversity, with just a 16% female ratio. Leaders in this group are most likely to hold an MBA — 44% have this qualification, while other academic backgrounds are varied, with 13% holding a PhD and 15% being qualified veterinarians.

Encompassing roles in research and development (R&D), manufacturing, and corporate development and strategy, this group oversees the core operational functions that facilitate in-house innovation and expedite access to external sources of innovation.

Innovation-enabling Leaders

Encompassing roles in research and development (R&D), manufacturing, and corporate development and strategy, this group oversees the core operational functions that

facilitate in-house innovation and expedite access to external sources of innovation. Innovation-enabling leaders demonstrate a similar age profile to commercial leaders, with an average age of 51, but have a more progressive gender diversity than CEOs or commercial leaders, with a 24% female ratio. Given the strong research focus of many roles in this category, it is unsurprising that this subgroup represents the highest prevalence of both PhD holders and veterinary qualifications: 25% and 29%, respectively.

Enterprise Services LeadersThis group includes key executives responsible for enterprise functions, such as finance, human resources, legal and regulatory affairs, information technology, and other essential functional areas critical to the organization’s success.

Enterprise services leaders have an average age of 51 and exhibit the greatest level of gender diversity of all the categories, with a 40% female ratio. 22% of leaders hold an MBA, 9% hold a PhD, and 7% are qualified veterinarians.

Demographic Profile of Leadership Team Members

The animal health industry is experiencing a period of rapid transformation, driven by the need for greater efficiency and effectiveness in developing and manufacturing new drugs, vaccines, and biopharmaceuticals. This evolution results in a shift toward more specialized and complex roles in R&D and technical operations. Therefore, it is essential for future leadership strategies to include upskilling and continuous education for executives in these areas to ensure they possess the necessary skills and knowledge to keep up with industry changes.

Leadership Turnover

An examination of CEO tenure at animal health companies reveals a notable disparity in tenure among CEOs at companies of different ownership structures. Current CEOs at publicly listed firms have an average tenure of 10 years, a stark contrast to the average of 3.8 years at privately held (investor-backed and family-owned) companies.

This notably shorter tenure at private companies reveals how the rapid and accelerated evolution of leadership profiles forms part of growth and transformation strategies at these companies. Specific and well-defined performance metrics, as well as constant reassessment of performance, strategy, and leadership competency, explain this shorter tenure. Rapid recalibration of leadership profiles leads to a dynamic talent pool, which allows for fresh perspectives, the introduction of diverse skillsets, and a focus on tangible results. On the other hand, momentum can be impeded by frequent leadership changes, with accompanying risk potential to cause difficulties in delivering on long-term strategy and vision.

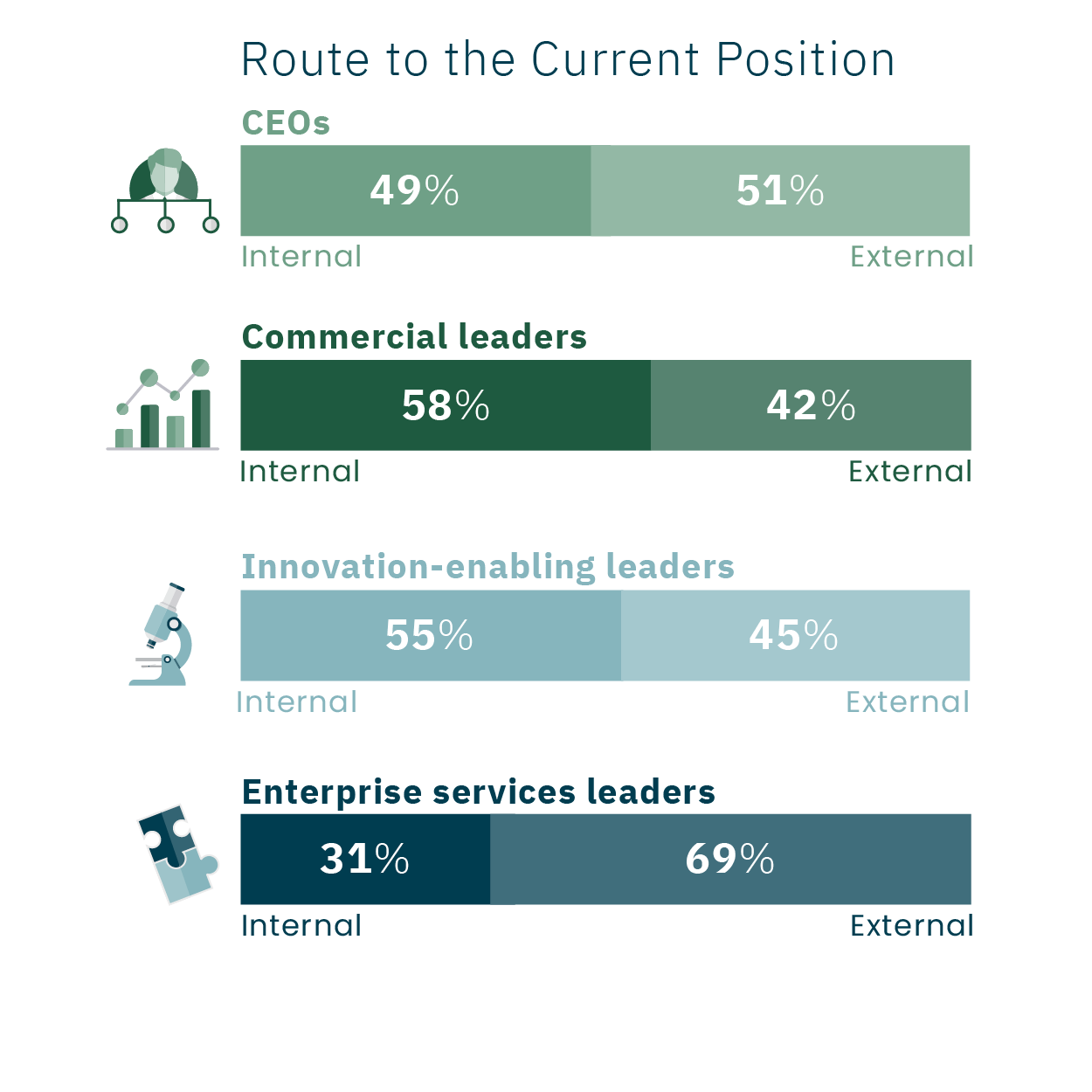

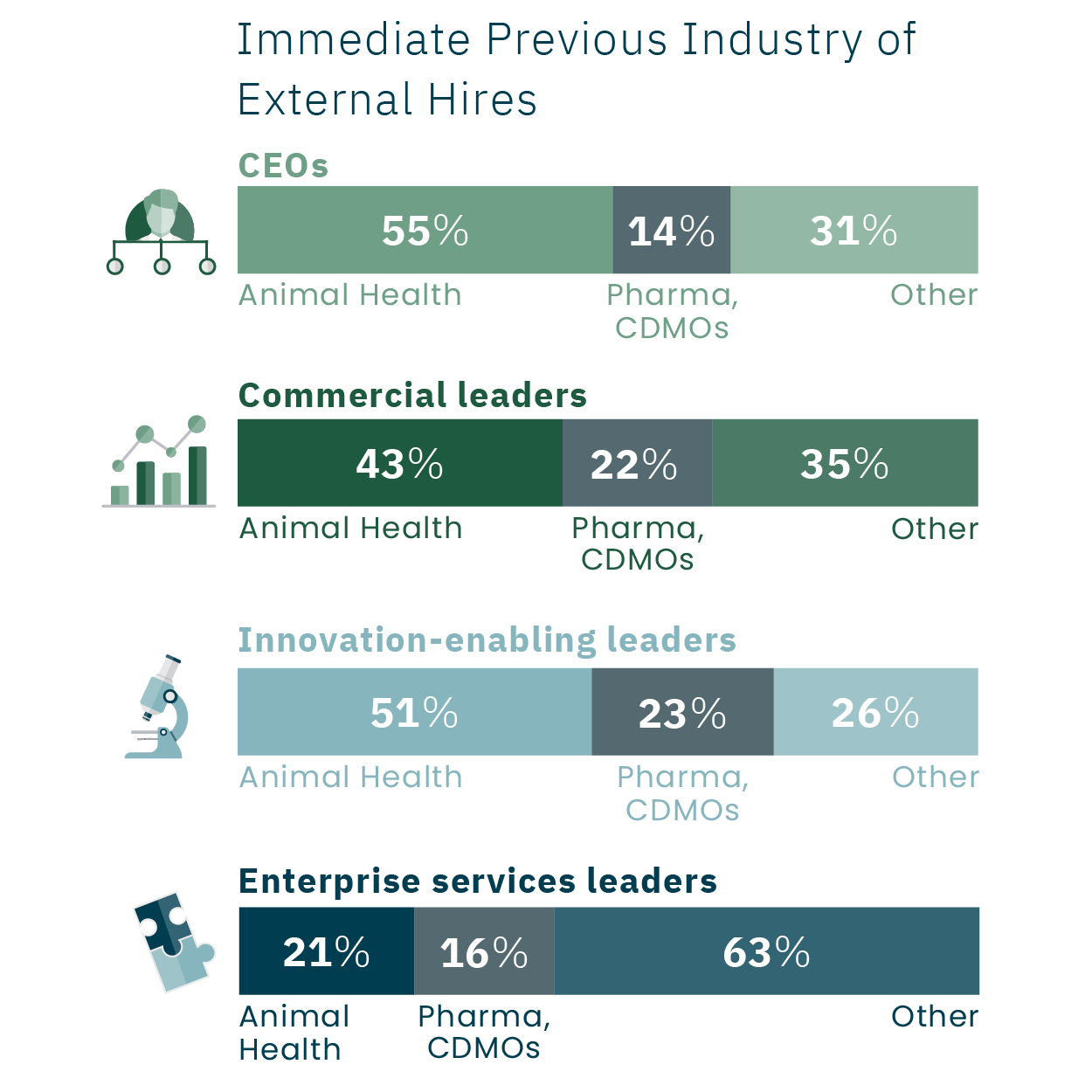

Talent Pools

The approach to CEO appointments varies across companies, with 49% promoted internally and 51% hired externally. CEOs are the group most likely to have prior experience in animal health, with 55% of externally hired CEOs coming from another animal health company. A further 14% come from pharmaceutical companies or CDMOs, while the remainder represents a broad range of industry experience, including healthcare and shipping logistics.

Given the rapid growth of the animal health sector and the ongoing need for innovation, it is challenging for the industry to meet its talent demands internally, necessitating talent sourcing from other industries. This is especially evident for enterprise services leaders, with 69% hired externally. Of these, only 21% had prior experience in the animal health industry, with the rest bringing a wide array of industry experience, including software, energy, retail, and consumer goods.

58% of commercial leaders are internal promotions, with 42% appointed externally. 43% of external hires come from the animal health industry, and 22% come from pharmaceutical companies or CDMOs.

Innovation-enabling roles were found to have a similar split between external hires (45%) and internal promotions (55%). Of the external appointments, 51% came from another animal health company, and 23% were hired from the pharmaceutical or CDMO industry.

Evolving Leadership Roles In Animal Health

Chief Veterinary Officer

While a Chief Medical Officer is considered a core member of any human pharmaceutical or biotechnology company, a Chief Veterinary Officer (CVO) role is still relatively uncommon in the animal health industry. When it does exist, the CVO may hold the title of a Chief Veterinary Officer, Chief Medical Officer, or Chief Animal Welfare Officer. In our sample, just one in three animal health companies has a dedicated CVO.

A CVO holds key responsibilities focused on veterinary care, including technical expertise and relationship-building with relevant stakeholders. Responsibilities include:

- Acting as a medical evangelist, i.e., advocating for animal health and wellbeing, including educating and raising awareness about animal health issues among various stakeholders and the public.

- Providing technical expertise and guidance on animal health and wellbeing issues, including disease prevention, treatment, and control.

- Building and maintaining relationships with key opinion leaders, regulatory agencies, and other stakeholders in the animal health industry.

- Providing leadership and direction to the company’s veterinary team.

- Staying abreast of the latest developments and trends in the animal health industry

and identifying opportunities for the company to innovate and differentiate itself in

the market.

Just four companies in our sample had a CVO on their executive leadership team, with two of these categorized as pet hospitals. A further eight companies had a CVO role present as a direct report to a member of the executive leadership team, with this phenomenon mostly appearing in both veterinary care and large pharmaceutical-heritage animal health companies.

Currently, approximately two-thirds of animal health companies do not have a dedicated CVO role at the executive level. Instead, the responsibilities are assigned to executives below the vice president (VP) level, with no executive VPs, senior VPs, or VPs specifically dedicated to veterinary/medical affairs.

The absence of a dedicated CVO role in most animal health companies suggests an opportunity for companies to consider adding this position to their executive leadership teams. By prioritizing the CVO role, animal health companies can ensure that they have a dedicated leader focused on veterinary care and animal health issues, ultimately contributing to better health outcomes and improved wellbeing for animals.

Chief Digital Officer

In today’s business landscape, digital strategy and expertise are essential functions, particularly in industries with a strong research and innovation focus, such as animal health. Our sample reveals that 35% of animal health companies have a dedicated digital role at the VP level or higher, with possible titles including Chief Digital Officer, Chief Digital and Technology Officer, Chief Digital and Information Officer, and Chief Digital Transformation Officer. While these digital roles are part of the broader technology remit, they are distinct from traditional IT roles. While AI is typically included in the scope of these roles, it is not explicitly mentioned in job titles (yet).

The responsibilities of a Chief Digital Officer are varied, focusing on driving digital transformation and leveraging technology to improve business outcomes.

- Defining digital vision and implementing digital strategy on an organizational level, working cross-functionally with different stakeholders, and looking to the technology-driven future.

- Implementing digital technologies to improve the efficiency of day-to-day processes, as well as exploring how these technologies can be utilized in decision-making, such as data analytics.

- Exploring the opportunities that AI and other cutting-edge tools provide for the organization.

- Promoting a digital culture and mindset throughout the organization.

65% of animal health companies do not have a named digital role at the VP level or above. In these cases, the responsibilities are generally split between multiple different roles, such as the CIO and digital leaders at the Director level, or embedded into distinct functions with specific purposes.

Chief Human Resources Officer

The role of a Chief Human Resources Officer (CHRO) or Chief People Officer (CPO) is of great importance in the animal health industry. Our sample reveals that approximately 65% of companies in the industry have a CHRO or CPO, with 49% of companies appointing this role to the executive leadership team.

The key responsibilities of CHROs/CPOs typically include:

- Establishing relevant structures, systems, processes, and a purpose-built human resources team.

- Aligning people strategy with the overall business strategy.

- Ensuring values, mindsets, policies, and ways of working to create a high-performing culture.

- Implementing and administering employee compensation, benefits, and performance management programs.

- Overseeing talent acquisition and talent management processes to ensure the organization attracts, retains, and develops top talent.

- Driving succession planning and building a talent bench to ensure the organization is prepared for future leadership needs.

- Serving as advisor and coach to the CEO, executive team, and board on a broad range of topics.

Regarding related functions, only 9% of animal health companies have dedicated Chief Diversity Officer titles — for example, a CHRO-Chief Diversity Officer joint title or Chief Talent, Diversity, Equity & Inclusion Officer. However, none of these roles currently sit on the executive leadership team.

Recommendations for Forward-thinking Leadership:

Given the dynamic nature of the animal health sector, several key recommendations for proactive and strategic leadership approaches are included. Drawing upon WittKieffer’s extensive industry expertise and executive search and leadership advisory work with clients, these recommendations aim to help industry executives navigate the evolving landscape, seize opportunities, and address leadership challenges effectively.

Align Leadership Strategy with Industry Trends:

- Focus on cultivating leaders with a strong understanding of the “One Health” philosophy.

- Develop leadership roles that specialize in “continuum of care” approaches.

- Ensure leadership teams include individuals with strong expertise in health policy and veterinary affairs, with nuanced understanding spanning diverse market geographies.

- Incorporate sustainability and environmental health goals into leadership objectives.

Strategically Create and Fill New Leadership Roles:

- Regularly assess organizational needs in light of industry trends.

- When creating new leadership roles, consider functions conducive to growth, digital transformation, and animal centricity.

- Ensure new roles and leadership profiles for those roles align with the company’s long-term strategy.

- Balance internal promotions with external hires to sustain institutional knowledge while bringing fresh perspectives.

Prioritize Succession Planning and Internal Talent Development:

- Develop robust succession plans for key leadership and mission-critical positions.

- Cultivate a diverse pipeline of potential leaders and invest in comprehensive leadership development programs.

- Accelerate the impact of veterinarians by developing their leadership, business, and functional acumen, preparing them for enterprise-level executive roles.

- Create opportunities for cross-departmental experiences and collaboration to broaden skillsets.

Enhance Cross-industry Partnership and External Talent Sourcing:

- Leverage interim and on-demand leaders to bring specialized expertise, especially during periods of rapid growth or transformation.

- Establish strategic partnerships with organizations in adjacent industries, such as pharmaceuticals, healthcare, and technology, to facilitate knowledge exchange and collaboration.

- Actively seek out external hires with diverse industry experience, particularly for enterprise services roles, to bring fresh perspectives and innovative ideas.

- Consider establishing a talent sourcing program to build relationships with best external talent and maintain a pool of qualified individuals for future leadership roles.

Embrace Digital Transformation and Innovation:

- Invest in leadership roles focused on digital strategy and AI implementation.

- Foster a culture of data-driven decision-making at all levels.

- Establish mentorship programs pairing experienced innovation leaders with high-potential employees.

- Encourage leaders to stay abreast of emerging technologies in animal health.

Foster a Culture of Diversity, Inclusion, and Continuous Learning:

- Prioritize diversity and inclusion initiatives at the leadership level.

- Elevate the role of human resources/people leadership on the executive team.

- Encourage a culture of continuous learning and risk-taking to keep pace with industry advancements.

- Implement mentorship programs to support talent development.

By implementing these leadership strategies, animal health companies can build resilient leadership teams capable of navigating complex challenges and opportunities. These strategies will help organizations attract, develop, and retain the visionary leaders needed to drive innovation and growth in this dynamic sector.

Methodology

To gain deeper insights into the leadership of animal health organizations, WittKieffer conducted proprietary research across diverse company types and financing statuses. Datasets were constructed to reflect the composition of the leadership teams for 35 leading animal health companies as of summer 2024. For each of the team members, publicly available information from company websites, press releases, BoardEx, and LinkedIn was collated to construct a dataset of career experience, educational background, and other relevant metrics.