Driving Success through Leadership in Venture-Capital-Backed Companies

Introduction

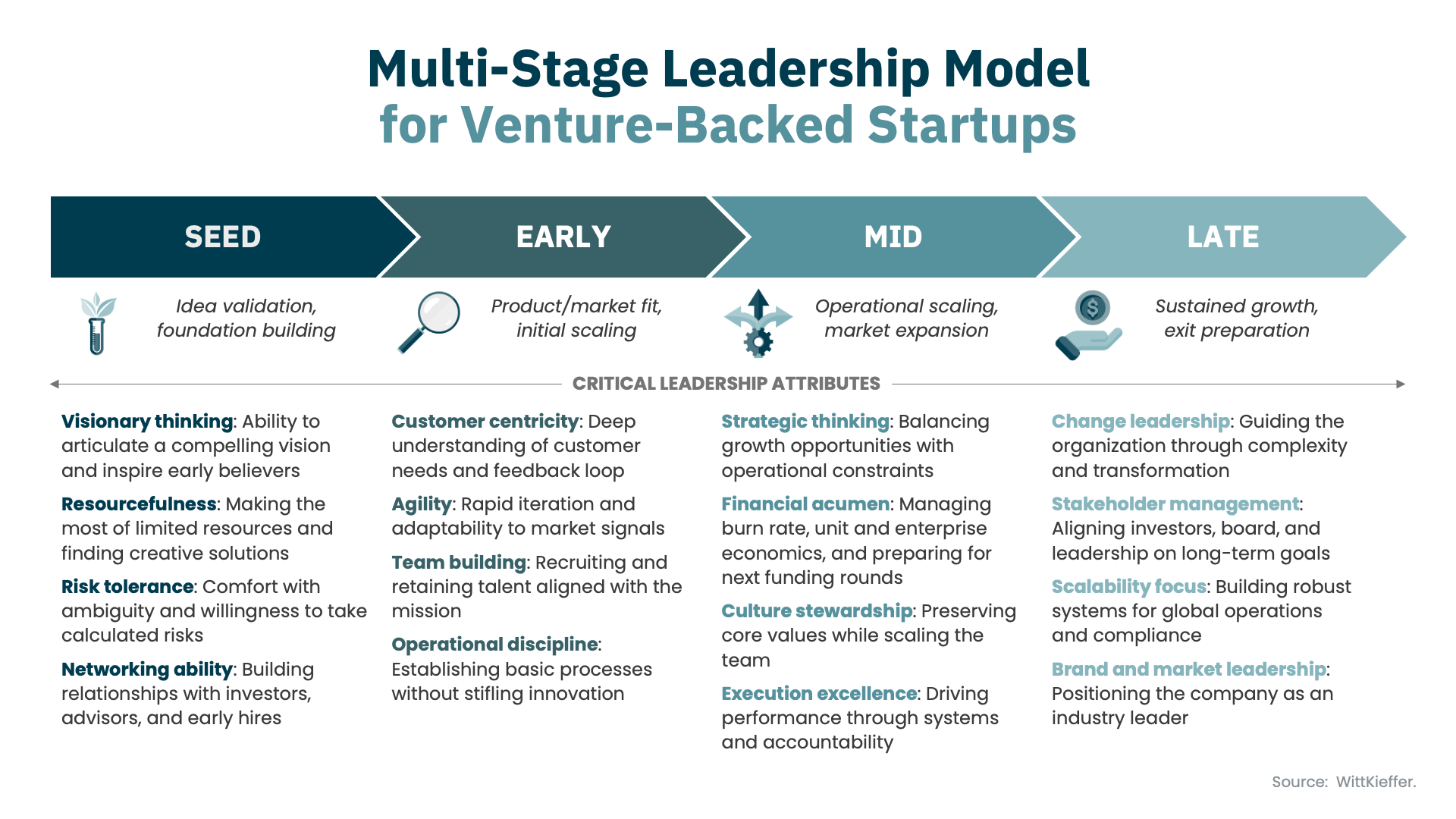

The journey of a venture-backed startup unfolds across distinct stages: seed, early, mid, and late. At the seed stage, ideas must be validated and transformed into minimally viable products or services. In the early stage, these offerings are tested for market fit and refined to align with ideal customer profiles. As companies progress to the mid stage, scaling becomes critical: building awareness, driving engagement, optimizing pricing, and strengthening operations and delivery. By the late stage, focus shifts to sustaining growth through partnerships, customer success, and service excellence. The capabilities built in each stage never go away; they are built upon by new capabilities in successive stages, all working in harmony to position the company for a successful exit. Throughout this journey, the entrepreneurial spirit of founders and early team members remains an essential ingredient. Their inventiveness, optimism, resilience, and tenacity are the heart of taming new business frontiers and deserve to be celebrated.

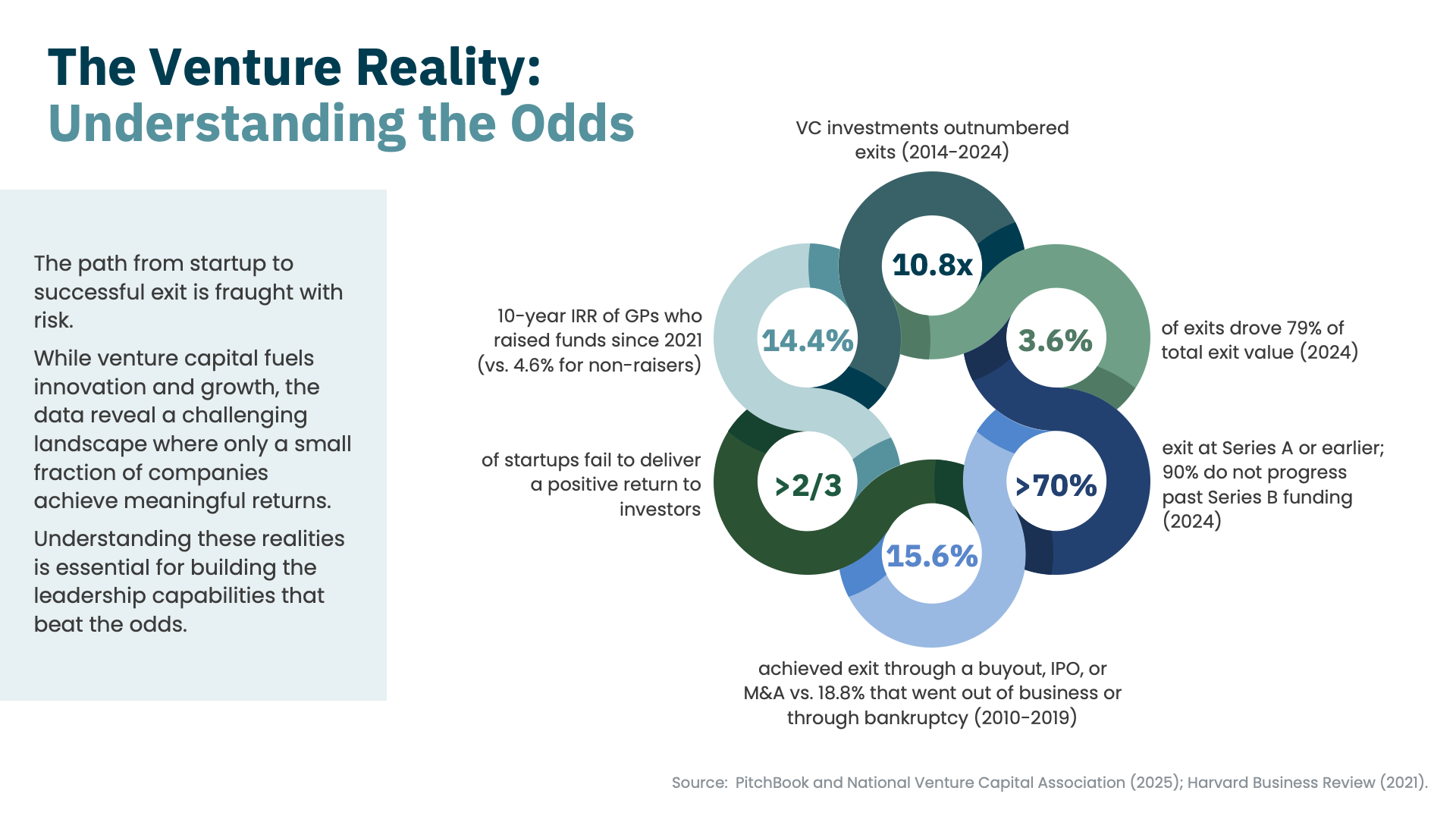

But the path is fraught with risk and rarely linear. Business model pivots are common, and the odds are stacked against founders and their backers, as a variety of data indicate: from 2014 to 2024, US venture investments outnumbered exits by 10.8x. The portfolio rule of thumb that one-third of portfolio companies fail, one-third return less than 1x, and one-third drive the returns seems to be holding true — in 2024, just 3.6% of exits (those over $500 million) captured 78.9% of total exit value. Meanwhile, of startups that raised seed or Series A funding between 2010 and 2019, only 15.6% achieved successful exits, while 18.8% went out of business or through bankruptcy.

Entrepreneurial spirit and drive remain at the heart of venture capital (VC), but success is not built on spirit alone. Studies consistently show that a leading cause of startup failure is not product or market misalignment, but leadership and team breakdowns. From founders who struggle to evolve into organizational leaders, to competing or misaligned viewpoints, to a lack of fundamental experience in critical functions, to teams that fracture under the pressure of delivering results — leadership gaps can derail promising companies at every stage of the journey.

In his seminal work “Why Startups Fail,” Thomas Eisenmann cites “bad bedfellows” as one of the principal reasons for startup failure, referring to the array of team members, advisors, and partners who surround the founder (Harvard Business Review, 2021). Eisenmann, in essence, is talking about the broader, quasi-virtual leadership structure of startups. Without the right bedfellows, the probability of failure is significant.

So, how do startup founders, future leaders, and investors ensure they have the right bedfellows? As private equity (PE) firms are learning, a leadership playbook — one that emphasizes intentional leadership team construction supported by leadership assessment, structured team alignment, and ongoing development — is as essential as the right technology, strategy, or market (WittKieffer, 2025). VC-backed companies, which operate in more ambiguous conditions, need this discipline even more urgently. In fact, the very existence of a VC-backed company relies on raising capital, and that is directly tied to the personality characteristics and quality of the founder and executive team.

Research confirms this connection and illuminates how specific founder traits impact outcomes. In a study by Columbia Business School, key personality traits of founders were shown to have material impact on startup success. Conscientiousness was found to have the biggest positive impact on the amount of funds raised but ultimately hurt exit probability as it conflicts with agility often needed to scale. In contrast, neuroticism positively impacted the likelihood of raising funds, but had a significant negative impact on dollars raised, number of participating investors, and exit probability (Columbia Business School, 2024). Essentially, unyielding passion and focus of a founder do not always translate into success.

In a survey of 885 institutional venture capitalists at 681 firms, 95% cited the management/founding team as an important factor in investment decisions, with 47% identifying it as the single most important factor, underscoring that capital access is fundamentally tied to leadership quality. The relative importance of the team was higher among early-stage investors. The most important characteristics cited were ability (#1), industry experience (#2), passion, entrepreneurial experience, and teamwork (Gompers et al., 2020).

By intentionally embedding leadership strategies throughout the investment lifecycle, investors increase the probability of success, reduce capital inefficiency, and maximize returns.

A Multi-Stage Leadership Model for Venture-Backed Startups

The natural evolution of a startup from idea to product to business to valued company necessitates a complex evolution in the core leadership attributes needed to navigate various stages of a startup’s journey to becoming a fully-fledged business. While the specific functional, market, or technical expertise may vary based on the nature of a startup’s operational priorities, there are common leadership attributes necessary for realizing success. In the model below, we break down core attributes by commonly recognized venture stages where those attributes become most important.

The attributes of one stage are not exclusive to those in the prior stages. In fact, the most successful companies are those that retain the essential attributes of prior stages while acquiring new attributes in successive stages. The demonstration of behaviors associated with these attributes will form the basis of a strong culture. In contrast, the lack of demonstrated behaviors will inhibit the establishment of a vital and thriving culture that attracts talent.

This is why the leadership roadmap is so important. If teams are built without recognition of the critical leadership competencies desired — not just the technical skills required — the risks of ineffectiveness, inefficiency, and misalignment rise dramatically.

Tools of the Leadership Roadmap

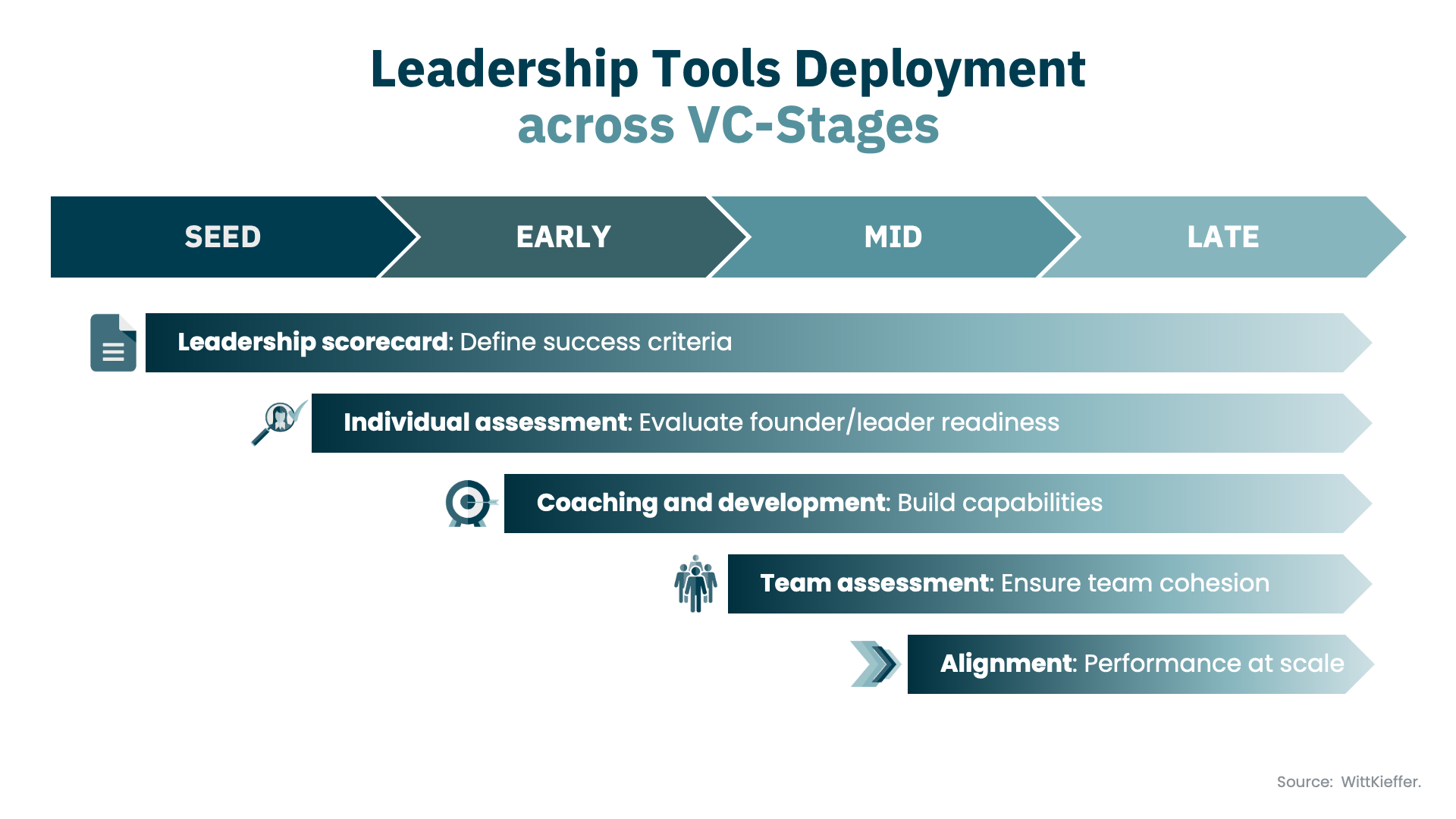

The leadership roadmap becomes actionable through a set of integrated tools that work in concert throughout the investment lifecycle. Scorecards establish the leadership success criteria for each stage, assessments diagnose individual and team capabilities against those criteria, and development programs close identified gaps before they become critical. This systematic approach ensures leadership capacity scales in lockstep with business complexity.

Scorecard Development

Organizational and leadership scorecards function as both diagnostics and blueprints. They clarify the leadership competencies, behaviors, and organizational capabilities required for the next phase of growth. Instead of relying on ad hoc judgments or the instincts of founders alone, the scorecard provides a structured, evidence-based way to define what “good leadership” looks like for the company’s specific strategy and stage. It not only highlights the capabilities leaders must demonstrate, such as delegation, financial fluency, or external presence, but also establishes the standards for evaluating new hires. Bringing in functional executives — whether in product, engineering, sales, or finance — requires more than technical brilliance; it requires alignment with the leadership scorecard that integrates cultural values, strategic goals, and scaling needs. In short, scorecards create the roadmap for transforming entrepreneurial drive into institutional leadership capacity, ensuring that new talent and existing leaders grow in alignment with the organization’s future.

Risks of leaving to chance: No reasonable investor, board, or leader would proceed with a business without a clear definition of success and performance metrics. The metrics of performance in many cases can be overwhelming — one recent board report we saw for an early-stage venture-backed company had no fewer than 75 individual metrics on it. So why leave metrics of leadership competency to chance and operate in the dark? Doing so risks misalignment, lack of clarity in expectations, poor team composition, and ultimately bad decisions across all areas of business. Speed, trust, and access to capital are lost. An already risky venture becomes even riskier.

Individual Assessment

Assessments provide a structured diagnostic that evaluates whether founders and leaders possess the essential competencies defined in a leadership scorecard. That leadership scorecard should address those essential competencies needed to progress from the current stage of a company to critical junctures and future stages. Accordingly, the scorecard has both diagnostic and prognostic elements to it, informing the leadership roadmap across stages. These assessments provide investors, boards, and leaders themselves with a clear understanding of whether a founder or other leader has the capacity to scale with the business, which leadership gaps must be addressed through complementary hires, and how investors can most effectively collaborate with the founder to maximize outcomes. Just as importantly, assessments help leaders confront blind spots early, giving them a roadmap for development. By incorporating assessment insights into coaching and development, leaders can intentionally embed values such as accountability, innovation, and transparency, ensuring that the company’s cultural DNA aligns with long-term success rather than accidental habits.

Risks of going in blind: Without data-driven insights, investors and boards often overestimate the readiness of founders and leaders, placing capital at risk behind those who are unprepared for the scaling challenges and requirements at the various stages ahead. Misalignment among founders and team members goes undetected until conflicts erupt, often irreparably damaging trust and slowing execution. Most dangerously, cultural toxicity can embed itself early, shaped by unchecked behaviors that harden into operating norms and become nearly impossible to undo later. Neglecting systematic assessment at any stage, therefore, risks execution failure, founder burnout, fractured teams, and cultural brittleness that will cripple the company’s ability to grow.

Team Assessment

In later stages, as organizational buildout occurs, team assessments are the cornerstone of leadership maturity. They provide a structured mechanism to evaluate whether the executive team is aligned, cohesive, and operating with an enterprise perspective rather than as a collection of functional silos. These assessments surface whether R&D, clinical, operations, commercial, and regulatory leaders are collaborating toward shared outcomes or working at cross-purposes. They highlight levels of trust, communication, and collaboration across functions and give investors a clear view of whether the leadership team is capable of executing at scale. Coupled with leadership scorecards, which directly tie executive competencies to strategic priorities, team assessments ensure that leaders are not only technically excellent in their domains but also accountable for the collective success of the enterprise. Together, these tools create a disciplined framework that transforms leadership teams from groups of functional specialists into high-performing units capable of driving coordinated growth.

Risks of discord: Without team assessments and institutionalized systems, high-growth companies may become prisoners of their own apparent success. Executives may have blinders, locked in their functional expertise without developing the broader perspective required to identify trade-offs and strategic decisions in the best interest of the enterprise. Silos calcify, as each department pursues its own goals, duplicating efforts and creating inefficiencies that erode speed and innovation. As complexity mounts, leaders who lack structured feedback and development often collapse under pressure, adversely impacting enterprise, departmental, and individual performance and talent retention. For investors, these failures are particularly damaging: stalled execution, cultural drift, and attrition raise questions about scalability, depress valuations, and slow the infusion of follow-on capital. In the most severe cases, promising mid- and later-stage companies are forced into restructuring simply because their leadership systems failed to mature as quickly as their business opportunities.

Development and Alignment

Each of the above tools contributes to knowledge of what is needed from leadership and whether those needs are being met. The light these tools shine on leadership effectiveness offers valuable opportunities to augment leadership behaviors conducive to success or intervene before success becomes that much harder to achieve. That intervention can come in different forms. Most commonly, and often reactively and abruptly, intervention comes through the transition of founders or leaders out of the organization and hiring new people to take their place. While at times necessary, such intervention is not always optimal. By incorporating assessment insights into coaching and development, leaders intentionally build competencies and behaviors that enhance the company’s cultural DNA, aligning it with long-term success rather than accidental habits. Leaders and their companies can productively progress along the multi-stage leadership model rather than risk discontinuity in their progression. The same goes for team alignment. When teams gain clarity on team roles, behaviors, and norms, teams can dramatically improve how they interact with each other and the broader organization. In turn, operational effectiveness, speed, and performance improve.

Risks of dysfunction: Where startups need capital, and capital demands leadership, the risks of dysfunction can be boiled down to survival. Premature or delayed leadership transitions will impede performance. Unnecessary transitions incur significant real costs in terms of talent acquisition, as well as the expenses associated with distraction, delayed decision-making, delayed investment, and/or delayed time to market and scaling. Poor alignment and bad culture can create a cancer within a team that spreads and detracts from an organization’s reputation, access to talent, and, again, performance. In each of these cases, new sources of capital will be, at best, wary and, at worst, inaccessible.

Which Leadership Tools Are Relevant When

As startups expand on multiple fronts, they naturally need to build repeatable processes that can support sustainable growth. But velocity without organizational clarity and leadership maturity is dangerous. This shift is not optional; it is existential. Many startups that appear to have product/market fit stumble here, not because the product fails, but because their leadership systems and structures cannot keep pace with the evolving organizational complexity that accompanies growth and maturation.

Start Early with Leadership Scorecards and Individual Assessments

Particularly for newer founders, scorecards and assessments clarify to all parties a shared definition of leadership success at or across stages and provide an objective evaluation of where a founder or early-stage leader stands. This provides leaders and investors with insight into which leadership gaps must be bridged through complementary hires and how they can work together most productively to maximize outcomes. As the company evolves through its later stages, so should the scorecard. Implementing new scorecard-based assessments at later stages and critical junctures creates the roadmap for transforming entrepreneurial drive into institutional leadership capacity, ensuring that new talent and existing leaders grow in alignment with the organization’s future.

Introduce Coaching or Development Before Cracks Appear

As previously shared, the value of knowledge lies in its ability to inform action. Through assessments, leadership gaps are identified. For those gaps that can be addressed through coaching or development, provide that at least six months ahead of when the desired competencies will become more important. This allows time for learning, practice, internalization, and demonstration to take hold. Continued monitoring and feedback beyond that period remain important.

Extend to Team as Complexity Accelerates and Ahead of Exit

By the later stage, a VC-backed company has moved beyond its startup roots to become a significant market player. It is no longer judged solely on potential, but on its ability to credibly demonstrate consistency, scalability, and business resilience. A successful exit is the ultimate proving ground for leadership, where years of innovation and execution are judged in a compressed, high-stakes window. Whether the outcome is an IPO, acquisition, or merger, the leadership team itself becomes the final litmus test of organizational readiness. Alignment and composure at the top are directly tied to valuation. Cohesive, resilient, and well-prepared teams reassure buyers and markets that execution risk is low, cultural stability is strong, and performance will endure. Team assessments, alignment sessions, and targeted executive coaching at these later stages ensure that the leadership team’s capability and functioning will meet the demands that markets and investors will make of them. At this stage, alignment and coaching are not simply preparation; they are essential tools that directly multiplies enterprise value.

Penny-Wise, Pound Foolish

In conversations with VC investors, we consistently hear several arguments against deploying the leadership playbook or tools described here. These arguments can be summarized as follows:

As serial investors with expert-level pattern recognition, we and our network can readily evaluate and reference leadership.

Undoubtedly, great investors possess an uncanny ability to recognize patterns in how companies succeed and how they fail. Such pattern recognition extends to strategy, operations, technology, business models … and, to people. However, particularly in VC, few people possess true expertise or the breadth of experience necessary to deploy data (e.g., interview-derived and psychometrics) and objective, interview-based approaches to assessing active leadership behaviors and the likelihood that the most effective of these will be consistently demonstrated in the future. Typically, investors tend to rely on track records, direct and indirect references, and interviews, as well as those of operating advisors. All valuable input, but not consistently demonstrative of effectively detecting leadership strengths, weaknesses, and future potential. This is evident in the startup failure rate and constant attribution of failure to leadership (Smart and Street, 2008).

These are costly investments that take away from more valuable uses of capital, such as product, or are pre-deal costs that may not be recaptured.

Given the number of opportunities that a venture capitalist will evaluate for each investment it executes, it would not make sense to apply scorecards and assessments to every opportunity that gets to detailed diligence or, maybe even, a term sheet. And, admittedly, fund structures can disincentivize the incurrence of broken deal expenses. Yet, the cost of a scorecard-based assessment is extraordinarily low relative to (a) the capital to be put at risk in a round and in the future, and (b) the value of risk mitigation. Better performance, objective leadership diligence for co- and future investors, lower costs of employee turnover, and more certainty in quality of hires all drive real returns well within the investment horizon.

Conclusion

Across all stages of the VC lifecycle, leadership is not a peripheral consideration or a “soft skill” — it is the decisive lever that determines time to scale, probability of achieving milestones, and magnitude of enterprise value created. From seed through exit, the ability of leaders to grow, adapt, and align directly correlates with investor confidence and company survival.

The evidence is clear: the absence of a robust leadership playbook creates consistent and predictable risks. At seed and early stages, founders without early assessments or coaching struggle with blind spots and burnout. The failure to transition from “doer” to “leader” creates bottlenecks and drives away critical hires. During the mid-to-late stages, the absence of team assessments allows silos to calcify, slowing execution and causing top talent attrition. In the late stages, untested leaders often falter under public scrutiny, eroding valuations. And at exit, leadership misalignment and instability translate directly into discounted multiples, lost confidence, and, in the worst cases, failed transactions.

By contrast, companies that embed systematic scorecard-based individual assessments gain an evidence-based understanding of leaders’ strengths and gaps, allowing investors and boards to make deliberate succession and hiring decisions. Those that implement team assessments ensure that executive teams operate as aligned, enterprise-level units rather than collections of functional experts. And those that invest in coaching and development provide leaders with the resilience, agility, and self-awareness to thrive under pressure. Together, these three pillars form a disciplined leadership playbook that rivals the technical, strategic, financial, and operational rigor investors already expect.

For VC investors, the implications are profound. Embedding leadership diligence into the investment thesis is no longer optional. Just as investors demand clear financial controls and KPIs, they must insist on structured leadership systems that reduce execution risk and amplify enterprise value. In doing so, investors not only protect the downside but also create a multiplier effect on the upside. Premium valuations, smoother exits, and accelerated growth are consistently correlated with strong, stable, and well-prepared leadership.

Ultimately, capital fuels ambition, but only leadership transforms ambition into enduring success. In a venture-backed world where ambiguity is the norm, companies that treat leadership as a strategic asset will be the ones that scale fastest, attract the strongest talent, inspire investor confidence, and deliver lasting impact. For founders, executives, and investors alike, the message is unambiguous: leadership is the most essential part of the value-creation equation.

About the Authors

Michael S. Castleman serves as Chief Business Officer and Executive Partner in Global Life Sciences, Investor-Backed Healthcare, and Interim Leadership at WittKieffer. Through deep experience as a venture capital investor and as an operating executive, Michael guides investors, boards, and executive teams through complex decision-making processes to enhance value creation.

Michael can be reached at [email protected]

Tjai M. Nielsen, Ph.D., is a Senior Partner in Global Leadership Advisory at WittKieffer, advising private equity firms, venture capital investors, and Fortune 500 senior executives on critical leadership challenges, including CEO succession, M&A, talent assessment and development, and organizational performance optimization.

Tjai can be reached at [email protected]