Enhancing Value Creation Through Impactful Leadership

“Oh, how times have changed!” we often hear as private equity (PE) markets adapt to the new realities of a more restrictive funding environment, higher cost of capital, and fewer exit paths. Value creation once again relies squarely on proven principles that are cyclically agnostic — organic growth and operational excellence.

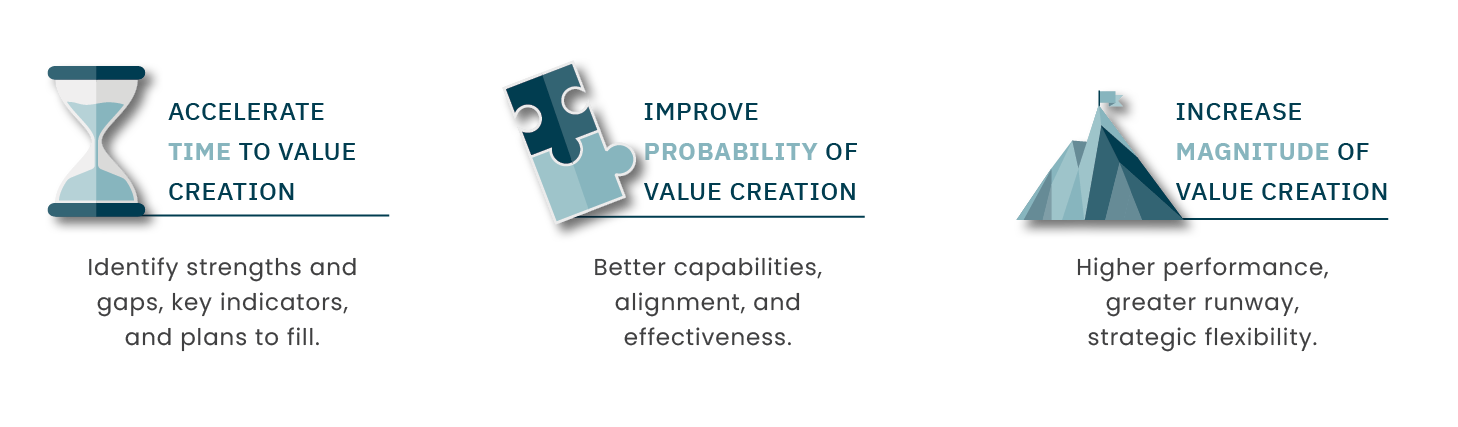

Impactful leadership — which we define as the right people operating as a high-performing executive team and fostering an enterprise culture of constructive performance — drives the organic growth and operational excellence that create value. While we believe this to be a fundamental truth, it is starkly evident in challenging times. Investors and their portfolio companies must adopt an integrated strategy to ensure impactful leadership is present throughout the investment lifecycle. An impactful leadership strategy accelerates time to value creation, enhances the probability of value creation, and increases the magnitude of value achieved.

Value through Impactful Leadership

PE firms operate across various industries, each presenting unique challenges and opportunities. By aligning investment firms’ focus with the specific needs of portfolio companies, investors maximize operational efficiency and strategic growth. In the healthcare and life sciences markets, which present distinctive hurdles and unparalleled opportunities to create value across financial, social, and quality-of-life metrics, unleashing impactful leadership is particularly urgent. Whether investing in specialty providers, behavioral health, urgent care, women’s health, advanced therapeutics, medical devices, or clinical services, PE investors must take a proactive approach to shaping leadership composition and structures that drive performance.

Given the essential relationship between impactful leadership and value creation in these markets, PE investors and their portfolio companies deserve a leadership playbook as robust as their operational and financial playbooks. Such a playbook directly unites value creation objectives and execution plans with the critical leadership capabilities required to deliver value. The leadership playbook enables investors and portfolio companies to act decisively.

This article outlines the steps needed to create and execute this core management discipline.

Creating and Leveraging the Playbook

Ensuring that the right executives and teams are in place to drive performance presents a multi-layered challenge. It requires understanding how strategic objectives translate to business and talent needs, how to assess leaders against those specific needs, and how to find or develop leaders who can perform across an inevitably dynamic investment period.

Define What You Need: The Leadership Scorecard

PE firms should follow a structured process to ensure consistent and measurable results. First, they must clearly define their leadership needs by translating strategy and value objectives into specific talent requirements.

Upon transaction completion, rapidly optimizing leadership and team effectiveness is crucial. But this work should start before transaction completion, side-by-side with developing the core principles of the strategic and operational elements of the value creation plan. An important first step is building an organizational scorecard that captures the essential deliverables necessary to achieve the value creation plan, while also informing preliminary threshold questions for leadership diligence. The gold standard is to refine and extend these scorecards to each leadership team role, identifying what great looks like, incorporate them as part of the onboarding of portfolio company leadership to new ownership, and set the groundwork for future assessments of incumbents or candidates.

Understand What You Have: Individual and Team Assessment

Having defined what great looks like, objectively measure it. Expert-led, deep-dive executive assessments objectively measure leadership potential and alignment against the leadership scorecard specific to the company and the role. This process ensures that leaders are not only capable of executing strategic priorities but also possess the agility, decision-making skills, and cultural alignment required for long-term success and value creation.

An effective assessment process combines behavioral and competency-based evaluations, peer benchmarking, psychometrics, and scenario-based leadership testing. These insights help investors and boards make data-driven decisions on executive placements, team structures, and talent development. Identifying high-potential leaders early allows investors and boards to proactively shape leadership succession and mitigate the risks of leadership gaps that could constrain value creation.

Beyond ensuring leadership effectiveness, executive assessments provide critical insights into an executive’s ability to align with the company’s strategic vision, to navigate complex operational challenges, and to foster a high-performance culture. Leadership gaps in fast-moving industries such as healthcare and life sciences can lead to costly mistakes, inefficiency, and missed opportunities. A comprehensive executive assessment process mitigates these risks by identifying leadership strengths, uncovering potential blind spots, equipping executives with the necessary tools for success, and equipping boards with the understanding of what to watch for and a plan to adjust when circumstances demand.

Team assessments of portfolio company leadership further enhance value creation by fostering alignment with sponsors and building top team performance. A strong team assessment process builds on individual leadership assessments by integrating confidential peer feedback, team-related interview topics, and team alignment sessions. Insights from team assessments lead to customized recommendations, preparing leadership teams to execute strategic plans effectively and help sponsors understand the unique nuances of their portfolio company leadership teams and organizations, significantly reducing the learning curve during the initial months of a new investment. Where possible, conducting a team assessment pre-close provides a data-driven picture of the top team and the organization, consistently uncovering key factors that could accelerate or slow value creation. In-depth understanding and appreciation for the capability, alignment, and culture of the top leadership team provide a differentiated advantage.

By incorporating assessments as a foundational element of the deal strategy, PE firms can build resilient, high-performing leadership teams that accelerate value creation and drive sustainable growth.

Accelerate Impact: Unleash Potential

Beyond ensuring the right people are in key roles and aligned to the performance needs of those roles, developing capabilities through executive and team coaching allows investor-backed companies to build resilience and adaptability within their organizations. Cultural alignment is equally vital. A strong, high-performance culture fosters collaboration and strategic execution. Such a culture is achieved through top team alignment, culture development, and structured change management. PE firms can mitigate risks and enhance performance by fostering a culture of trust and accountability.

Nobody is perfect. Executive coaching, especially after assessment against a specific leadership scorecard, enables executives to leverage their strengths to accelerate performance.

Regular coaching sessions — typically held every two to three weeks over a six-month engagement — offer a structured and psychologically safe environment for reflection, skill-building, and problem-solving. Coaching helps leaders enhance their decision-making capabilities and cultivate stronger relationships with investors, board members, and their teams by focusing on high-impact areas such as emotional intelligence, conflict resolution, and executive presence.

Sometimes, an assessment process reveals not only individual strength but also executive team opportunity. Providing an intentional approach to improving team dynamics and removing obstacles that hinder performance can unlock a team’s full potential. In PE-backed healthcare and life sciences companies — where collaboration among clinical, commercial, and operational leaders is critical — misalignment can be debilitating to performance and to patient safety. Developing the team bridges these gaps by facilitating open dialogue, improving communication, and aligning leadership with strategic objectives.

A valuable starting point is in-depth interviews of team members to analyze leadership styles, communication preferences, and potential sources of friction. Subsequent facilitated team sessions can help leadership teams identify pain points, build trust, and establish a unified vision to drive operational excellence.

Psychological safety is another crucial element of team development, particularly in high-stakes healthcare environments where clear communication can impact patient outcomes. Fostering a culture where executives feel comfortable voicing concerns, challenging assumptions, and collaborating on solutions is critical to ensuring optimal outcomes. Ultimately, concentrating on developing portfolio company leadership teams enhances collaboration, optimizes leadership alignment, and eliminates performance roadblocks, positioning portfolio companies for sustained success.

Executing the Playbook: Discipline and Agility

Having set the foundation for an impactful leadership team — the performance scorecard, a deep understanding of leaders individually and as a team, and individual and team development plans — the critical next step is, of course, execution. Success is rarely, if ever, linear. Being prepared for challenges or opportunities and acting decisively are essential to maximizing time, probability, and magnitude of value. We believe strong leadership playbook execution entails the following:

- Continuous monitoring of executive performance against the leadership scorecard is as essential as monitoring financial, sales, and operational metrics. Embed this monitoring as part of investment oversight and board processes.

- Actively provide executives with feedback on leadership performance, not just financial or operational performance, along with offering constructive support for development.

- Establish timelines for remediation and action when early warning signs are triggered.

- Engage leadership talent partners early in understanding the market for talent and benchmarking leaders and leadership teams. Move to search quickly when warranted.

- Deploy interim and on-demand leaders to enhance capacity and skills to deliver on critical initiatives and projects that are essential to the value creation path. Interim leaders may be sourced from a PE firm’s operating advisor network or through an independent interim leadership partner.

Any plan is only as good as the disciplined and agile execution that accompanies it. The same is true for the leadership playbook.

Special Consideration: Preparing for a Profitable Exit

A well-structured exit strategy is essential for maximizing returns on investment. The playbook process described above can and should be revisited in this context, with a focus on executive succession. Executive succession planning ensures leadership continuity by defining strategic priorities, identifying potential successors, and implementing targeted development plans.

For companies preparing for an IPO, leadership readiness is paramount. Ensuring the right executives, defining mission-right capabilities, understanding of public investor expectations, transitioning board composition, establishing new board engagement models with leadership, and implementing strong public company governance can significantly impact public market performance. In essence, the leadership performance scorecard needs to change to ensure public market success. The objective of revisiting the playbook process is not to prevent embedded leadership from enjoying the public market fruits of their efforts. Rather it re-orients leadership to the entirely new context in which they must operate individually and as a team. It identifies new development paths and change triggers that help to ensure companies meet the demands of this new context.

Fundamental Leadership Needs

Three fundamental leadership needs across all phases of the investment lifecycle:

- Do you have the right people to define and lead the value creation plan?

- Do they have the necessary capabilities to execute that plan?

- Is there leadership alignment and culture that brings out the best in the organization?

Concluding Remarks

In the competitive PE landscape, investment success hinges on more than just capital — it requires strong leadership, cohesive teams, and a high-performance culture. Particularly in the healthcare and life sciences sector, where regulatory complexity and operational challenges are high, PE firms should take a strategic approach to leadership selection, development, and alignment. Through executive and team assessments, targeted coaching, and structured post-deal acceleration, PE firms can unlock the full potential of their portfolio companies. By building a comprehensive impactful leadership playbook, investors accelerate value creation, reduce risk, and maximize returns. A disciplined approach to due diligence, leadership optimization, and cultural alignment ensures that companies are well-positioned for sustainable growth, successful exits, and long-term impact.

About Authors

Michael S. Castleman serves as Chief Business Officer and Executive Partner in Global Life Sciences, Investor-Backed Healthcare, and Interim Leadership at WittKieffer. With deep expertise in organizational transformation and strategic leadership, Michael guides investors, boards, and executive teams through complex decision-making processes to enhance value creation.

Michael can be reached at [email protected]

Tjai M. Nielsen, PhD, is a Senior Partner in Global Leadership Advisory at WittKieffer, advising private equity firms, venture capital investors, and Fortune 500 senior executives on critical leadership challenges, including CEO succession, M&A, talent assessment and development, and organizational performance optimization.

Tjai can be reached at [email protected]