Consumer Empowered: Are Your Leaders Prepared for the Market Shift?

The direct-to-consumer healthcare market encompasses an array of medicine, digital therapeutics, primary and specialty providers, and innovative technologies. Examples include concierge medical services, medical spas, weight loss centers, mindfulness programs, sexual and sleep health services, luxury rehab facilities, clinically validated skincare and longevity services, and “food as medicine” programs. Projections indicate that the global health and wellness market is anticipated to reach a substantial USD 9.2 trillion by 2033 (Precedence Research, 2024). To provide the best possible experience and outcomes for consumers and maximize returns for investors, these services require a leadership team that is a unique hybrid of backgrounds and experiences.

Historically, investment focus in healthcare followed a traditional healthcare business model, with specialty physician practices, urgent care centers, and other traditional healthcare environments responding to illnesses, accidents, and emergencies as they occur with their patients. The industry is undergoing significant transformation, however, as consumers take a more active and direct interest in their own health and wellness. According to McKinsey research, 82% of US consumers now consider wellness a top or important priority in their everyday lives (McKinsey, 2023). This increased consumer demand is a significant factor at play in the recent increased interest from the investor market: PitchBook’s 2023 Q4 Health Services report identified medical spas as the number one exception to the general healthcare trend of declining deal activity and valuations in 2023, with a positive outlook for sustained investor interest. This shift is also driven by a desire from investors and providers to tap into markets not dependent on payers and traditional reimbursement models.

The direct-to-consumer healthcare sector offers a number of other qualities appealing to investors:

- Cash pay. Many direct-to-consumer healthcare services operate on a cash-pay basis, providing high margins and a stable revenue stream. With these models, healthcare providers receive immediate payment from patients, eliminating the uncertainty and delays associated with insurance reimbursement rates and claim denials.

- Subscription-based. Some direct-to-consumer healthcare services (e.g., concierge medicine) and products (e.g., nutritional and medical food supplements, weight loss aids, and skincare) operate on a subscription-based model. This provides a predictable and recurring revenue stream, making it easier for investors to forecast returns.

- Streamlined regulatory environment. Direct-to-consumer healthcare operates in a regulatory landscape that is more straightforward for businesses and investors, making it easier to navigate.

- Reduced administration. Managing insurance claims involves significant administrative work and costs. Conversely, cash-pay models simplify billing and reduce administrative overhead, allowing healthcare providers to focus more on patient care and less on paperwork.

- Scalability. Investors see synergistic opportunities at scale, leading to significant returns on investment, for instance, through operations standardization, cross-selling, patient acquisition, staff training, and back-office consolidation.

Investment Shift to Direct-to-Consumer Healthcare

The combination of promising benefits, lower barriers and cost of entry, and high growth potential has sparked an increased interest from private equity investors who see the opportunity in direct-to-consumer healthcare to deliver positive results to consumers and enhance fund performance alongside.

Additionally, this presents an advantage for investors to disrupt a market and potentially roll up the fragmented industry, capturing market share in the process. PitchBook’s data shows a proliferation in medical spas over the past decade (PitchBook, 2023), acknowledging that until the latter half of 2023, the industry was too fragmented to be wholly appealing to middle-market investment firms. According to PitchBook’s data, 2023 saw the most growth deals in aesthetic dermatology to date, with at least eight growth deals announced in the first 10 months of 2023 — compared to just one in 2020 (Burleson, 2023). This heightened interest in direct-to-consumer healthcare extends to concierge medicine and subscription-based healthcare delivery. As a result, an estimated 5,000 to 7,000 concierge medicine programs and subscription-based healthcare delivery physicians now operate within the United States, sparking interest from private equity investors (DataHorizzon Research, 2024; Fierce Healthcare, 2024).Private equity firms entering the direct-to-consumer healthcare sector can leverage several key value-creation strategies.

These include implementing subscription or membership options, enhancing the patient experience, exploring consumer financing options, scaling up service portfolios, and diversifying revenue streams. Furthermore, technology offers additional avenues for value creation: investing in advanced technological solutions for a broader spectrum of procedures, leveraging artificial intelligence (AI) to optimize digital marketing efforts, and providing consumers with access to longitudinal health, among other innovative strategies.

The sector demonstrates significant growth potential, buoyed by cultural shifts that foster increased consumer acceptance, empowerment, and engagement. Beyond these overarching trends, specific attributes of the direct-to-consumer offerings fuel robust and sustained market expansion, including strong customer loyalty, inherent growth, less stringent regulatory oversight, a focus on subscription models, and the consumer preference for an increasingly personalized healthcare experience where they feel their healthcare providers truly listen to them. McKinsey’s 2024 Future of Wellness study underscores the ripe opportunities for innovation and investment in women’s health, weight management, and in-person fitness (McKinsey, 2023).

In alignment with market growth projections and the evolving consumer embrace of health and wellness as a core consumption category, the industry is on the brink of significant transformations, most notably:

- Medical innovation. Breakthroughs in GLP-1s are unveiling fresh avenues for weight management solutions, nutritional programs, and partnerships, while advancements in hormone replacement therapy and hormone-free alternatives are reshaping menopausal symptom treatment.

- Services expansion. Increased demand is anticipated in areas like male medical aesthetics (including hairrestoration and testosterone replacement therapy) and essential diagnostic tools integral to preventive healthcare initiatives (such as oxygen therapies, glucose monitoring, genetic testing, and other preventive diagnostic options).

- Technology. AI continues to catalyze significant shifts in the industry, revolutionizing processes through predictive analytics, personalized treatment recommendations, and improved operational efficiencies.

- Industry landscape. The anticipated industry consolidation, addressing the current fragmentation, presents a spectrum of challenges and opportunities for private equity firms operating in this domain.

- Partnership opportunities. Rather than competing with traditional healthcare providers, consumer health and wellness companies are seeking out partnerships with them. Many individuals still rely on a physician for guidance and coordination for holistic health.

This approach allows consumers to make informed decisions and explore various healthcare options while seeking validation from their trusted healthcare providers.

Strategic Leadership Considerations for Consumer-centric Success

In a quickly evolving landscape with no signs of slowing down, it is imperative for investors tometiculously select their leadership teams, recognizing the unique blend of skillsets necessary for success in direct-to-consumer healthcare.

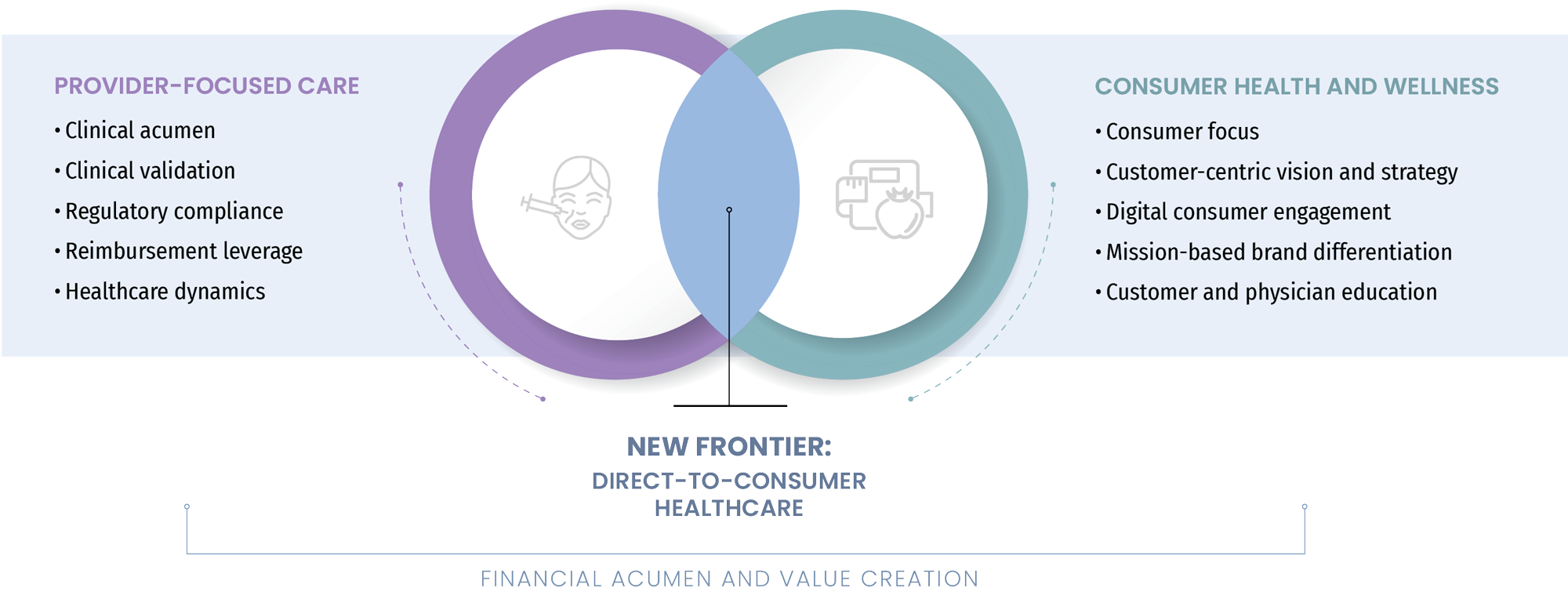

Competencies and Skillsets Required in Direct-to-Consumer Healthcare

Moreover, leaders and teams must be adept at navigating significant growth and expansion while simultaneously embracing the importance of brand differentiators and the lifetime value of their customers. In the direct-to-consumer healthcare sector, transformative leadership is crucial for driving innovation, growth, and customer-centricity.

Competencies and skillsets brought by executives coming from rather traditional healthcare backgrounds:

- Clinical acumen: Profound understanding of operationalization of clinical best practices, patient care, and the healthcare environment to ensure the delivery of high-quality patient services.

- Clinical validation: Ability to assess and validate the efficacy and safety of medical procedures and treatments, ensuring adherence to industry standards and regulations.

- Regulatory compliance: Proficiency in navigating intricate healthcare regulations and ensuring organizational compliance with legal requirements for patient safety and data privacy; commitment to ethical practices, fostering trust among consumers and stakeholders.

- Healthcare innovation: Experience in driving innovation in healthcare organizations, e.g., physician specialty practices, by implementing new technologies and improving patient outcomes through evidence-based approaches.

- Reimbursement leverage: Knowledge of various payment models, including fee-for-service, capitation, and value-based care, and the ability to navigate and optimize reimbursement rates; experience in exploiting reimbursement levers to optimize revenue streams and ensure financial sustainability.

- Healthcare dynamics: Understanding of the complex healthcare landscape and dynamics, including the roles of various stakeholders, the impact of policy changes, and the evolving trends in healthcare delivery and financing.

Competencies and skillsets brought by executives coming from consumer health and wellness backgrounds:

- Consumer focus: Strong orientation towards and understanding of consumer needs, preferences, and behaviors to develop personalized services, enhance consumer experience, and create seamless and engaging consumer journeys and feedback loops to drive and refine customer loyalty.

- Customer-centric vision and strategy: The ability to foresee the future of healthcare, identify trends and product-market fit, and create a strategic plan that aligns with evolving consumer demands and technological advances.

- Digital consumer engagement: Expertise in leveraging data, AI, digital technologies, and platforms to increase consumer engagement, optimize marketing and retention strategies, and drive business growth, as well as encourage teams to experiment with new ideas and approaches to stay ahead of competitors.

- Mission-based brand differentiation: Skilled in cultivating and maintaining a differentiated brand that not only stands out in the market, but also makes a meaningful difference in the lives of customers through emotional storytelling highlighting the company’s commitment to improving quality of life, driving positive change, and delivering exceptional

impact to customers. - Customer and physician education: The ability to build trust and empower consumers and physicians through education, creating a competitive edge in an increasingly competitive market.

For leaders, regardless of their prior institutional experience, financial acumen and value creation are essential competencies. They must demonstrate a proven track record of driving revenue growth through innovative business models and go-to-market excellence, as well as effectively communicating the company’s vision and strategy to stakeholders.

In organizations operating in or pivoting to direct-to-consumer healthcare, the ability of leadership teams to embrace consumer centricity is a core principle. Here are a few leadership initiatives essential for navigating the shift towards consumer-centric healthcare to drive innovation and value creation.

- Emphasize consumer centricity: Since the vitality and prosperity of this industry pivot on consumer acceptance, leadership teams must maintain a steadfast consumer focus. Understanding business-to-consumer dynamics and operating in a manner that deeply resonates with consumers is paramount, diverging from traditional healthcare paradigms. Additionally, implementing sustainable business practices that not only meet regulatory requirements but also resonate with socially conscious consumers is critical.

- Augment team skillsets: Given the distinctive attributes and consumer-centric focus of direct-to-consumer healthcare, organizations should cultivate these skills internally and actively seek out external talent with prior experience in consumer businesses to complement the existing leadership experiences.

In times of critical initiatives or transitions to new business models, interim and on-demand leadership can provide essential expertise, agility, and objectivity, thereby accelerating value creation. - Foster a hybrid team: The interdisciplinary nature of direct-to-consumer healthcare calls for a diverse team with a broad spectrum of backgrounds and experiences. Ideally, leadership teams would include experienced executives with a strong consumer orientation and brand management, as well as leaders with extensive clinical expertise and technology specialists proficient in leveraging AI,cutting-edge tools, and partnerships to enhance the company’s reach and offerings.

- Enhance team effectiveness: To establish outstanding conditions for a cohesive leadership team, with diverse cultures and backgrounds coming together, we recommend answering four key questions: the “why” (shared ambition), the “what” (collective priorities), the “who” (appropriate composition), and the “how” (norms and relationships). By aligning the leadership team around these fourelements, the team can foster more effective decision-making and implementation of the strategic agenda, leading to better business outcomes.

WittKieffer’s capabilities in executive search, leadership advisory, and interim/on-demand leadership solutions help investors and organizations develop transformative and impactful leadership.

In conclusion, the shift towards direct-to-consumer healthcare represents a significant opportunity for investors and healthcare providers to deliver positive results to consumers while enhancing investment performance. The success of this sector is driven by a unique blend of skillsets and experiences, requiring a leadership team that can navigate significant growth and expansion while maintaining a steadfast consumer focus and improving patient outcomes. As the industry continues to evolve and transform, it is imperative for investors and healthcare providers to meticulously select and develop their leadership teams, embracing the importance of consumer centricity, brand differentiation, and the lifetime value of customers. With the right leadership in place, the direct-to-consumer healthcare sector is poised for significant growth and success in the years to come.

References

- Burleson, Emily (2023). Private equity raises bets on Botox-dealing medspas.

- DataHorizzon Research (2024). Concierge medicine market.

- Deloitte (2023). The dawn of a new health CEO: The role of consumer-centricity in the Future of Health™.

- Fierce Healthcare (2024). Hospitals cash in on a private equity-backed trend: Concierge physician care.

- McKinsey (2023). The trends defining the $1.8 trillion global wellness market in 2024.

- Solomon Partners (2024). Medspa market overview, Q2 2024.

- PitchBook (2023). Q2 2023 healthcare services report.

- Precedence Research (2024). Health and wellness market size, share, and trends 2024 to 2033.