- Home

- Insights

- Capability, Capacity, Culture, and Communication: Are You Ready for the Joint Challenges of US and EU Pharmaceutical Market Evolution?

The Inflation Reduction Act (IRA) and Joint Clinical Assessment (JCA) constitute the most consequential legislative shift for the pharmaceutical industry in recent decades. Together, they bring more concentrated demands for information and require the industry to answer more challenging questions within shorter timeframes. Despite recognizing the upcoming landscape changes, companies appear underprepared and unclear on how best to adapt.

Wickenstones and WittKieffer jointly hosted a roundtable discussion with industry experts in June 2024 to explore challenges and opportunities associated with the IRA and JCA. Central to this discussion was that incoming legislation will challenge current organizational structures by increasing overall evidence demands and will reshape decision making for development plans. Here, we evaluate these challenges and recommend ways for pharmaceutical companies to reshape these structures to maximize asset potential.

Challenges with the IRA

Introduced in 2022, the IRA’s primary pharmaceutical focus in healthcare is to address spiraling Medicare expenditure. Cost-control measures in the IRA are twofold: 1) beginning in 2025, Medicare will have the authority to limit list prices by negotiating pricing for drugs with high Medicare expenditure and no generic equivalents; and 2) the legislation establishes a $2,000 annual cap on out-of-pocket expenditure, with no backup from federal resources above this cap, which has pressured drug pricing and likely implies new step edits will be required to reduce insurance exposure to excess costs. Particularly in the case of direct negotiation with Medicare, these changes make pricing less predictable and may reduce the control manufacturers have over pricing negotiations.

Overall, cost-control measures increase pressure to maximize profitability early in the drug life cycle and change incentives around speed to market, which favors early indications with larger populations:

- Launch sequencing will become moreconsequential, and organizational changes will be required to launch more indications in parallel.

- Launch efficiency will increase in importance, as profitability is under pressure.

Successfully adapting to these pressures will require effective interaction between functions that do not normally collaborate and will benefit from more prominent market access input earlier in decision making. These changes will consume resources at the global level, creating a potential resource void for other international activities.

Challenges with the JCA

The JCA will come into effect for the first tranche of drugs in January 2025. It is aimed at accelerating patient access by reducing duplication of dossier development between EU countries. However, there are concerns that it will have the opposite effect. The assessment scope phase will only be 90 days, and manufacturers will have around six months to develop a strategy and submit evidence. These timelines provide very limited room for additional evidence generation and will require a working overlap with regulatory submissions. Given these concerns, several challenges and considerations arise relating to the JCA introduction:

- Clinical assessment at the European level requires new resources within already stretched

regions (Europe), while local reimbursement review means that resourcing needs to be maintained at the affiliate level. - The current lack of guidance and collaboration with industry from the European Medicines Agency (EMA) means that companies have not begun to fully prepare for the JCA. This delay requires developing new structures and capabilities while trying to deliver against restricted JCA timelines.

- Greater transparency in the JCA dossier, compared to local submissions, increases the need to set the correct asset strategy early and maintain message discipline through to launch. It will be crucial to ensure that affiliate submissions remain aligned with the JCA submission and each other.

To manage the demands of both JCA and affiliate-level reimbursement processes — and to ensure that the EU market remains viable for the industry — cross-functional and cross-organizational teams must find ways to maximize their output.

Together, the IRA and JCA will compel the pharmaceutical industry to be smarter with its time and resource allocation. Thriving through these changes will require a profound shift in organizational dynamics. This does, however, offer a unique opportunity to transform organizational norms in a way that will make companies more nimble in future landscape developments.

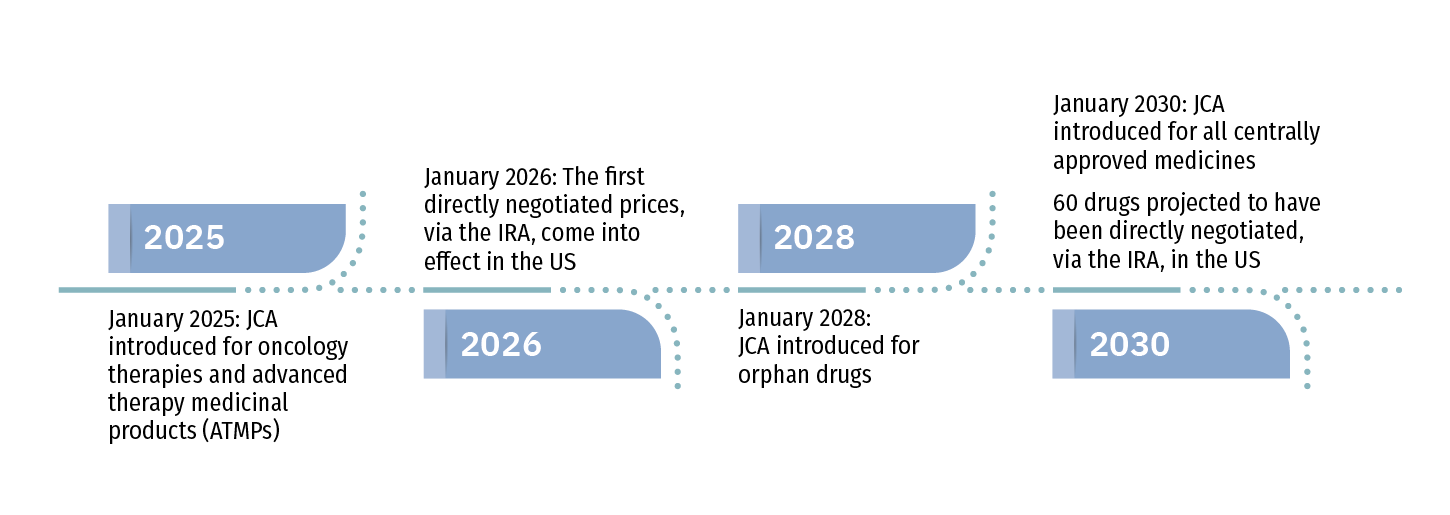

Legislative Timelines for IRA and JCA Introduction

Opportunities for Change

Incoming legislation pushes the pharmaceutical industry towards a more functionally integrated operating model. Fully integrated teams, which bring clinical development and regulatory affairs into closer alignment with market access from the beginning of asset development, lead to efficiencies and enhanced outcomes.

Culture

One thing needed is a major cultural move towards greater internal cohesion. Partly driven by organizational structure, pharmaceutical companies often act in pseudo-siloed functions that operate independently and, occasionally, competitively. This practice must be broken so that a “single team” mentality can be nurtured. Shared cross-functional targets will help make collaborating mutually beneficial, rather than transactional, and may encourage more proactive interactions between teams.

By increasing early-stage collaboration, launch sequencing decisions are likely to be of higher quality, as steering from to-market functions will provide access-related insights that would typically be underrepresented in early decision making. Moreover, shared mutual objectives between organizational levels will make it easier for affiliates to remain aligned with overall product strategy.

In turn, increased alignment will permit a development of decision-making power to affiliates and regions. This will streamline the process by reducing the need for extensive coordination with the global enterprise team — particularly in the European setting.

Importantly, however, development of power will require increases in competency in certain areas to ensure that decision-making quality is maintained.

Competency and Capacity

During the roundtable, there was a clear sense from experts that industry functions are not “game ready” for the incoming legislative changes. What needs to be done to remedy this?

A broad increase in capacity, capability, governance, and process within Europe is required. This should be prioritized at the regional level, where the greatest impact can be made and new decisions are being taken by customers. Companies with regional teams are more likely to be successful under the JCA.

Where resources are particularly stretched, dynamic, cross-functional sub-teams can be created as needed for a single deliverable or workstrea

m. Bringing together high performing, autonomous groups will provide more rapid responses to individual questions that arise through the submission process. For this approach to be most effective, group members should already be familiar with the subject and come from teams with compatible working norms, which further underscores the need for cultural change.

Capability uplifting will markedly increase the output and independence of affiliates and regions, by reducing their requirement for higher support. Chief among these will be improved strategy development and value communication skills. A more nuanced understanding of value communication is likely to benefit the alignment of national and JCA strategies, as evidence needs and payer value vary widely between markets. Further, honing negotiating skills may mitigate potential communication challenges arising from clinical assessment at the European level. Equipping affiliates to enter local negotiations with the correct skillset will improve the consistency of success between markets.

Biotechs will acutely feel the increased regulatory burden and accelerated evidence development timelines imposed by the JCA alongside financial pressure from the IRA. To help alleviate some of this impact, pharmaceutical companies should select external partners that effectively supplement the work and grasp the specific challenges faced by smaller organizations. One desirable strategy would be to move toward long-term partnerships where collaborators provide guidance and input for strategic decisions. External expertise in JCA submissions will prove particularly valuable for biotechs and smaller manufacturers. Such partnerships will also reassure investors that opportunities for growth in the EU are not “left on the table.”

While internal changes are crucial for future success, the industry must be careful not to overlook proactive market shaping. Representatives such as the European Federation of Pharmaceutical Industries and Associations (EFPIA, 2024) as well as the French Industry Association and the German Association of Research-based Pharmaceutical Companies (Leem & vfa, 2022) are already advocating for clearer guidance on evidence and submission requirements, as well as for greater collaboration with industry on JCA policy development. During the roundtable, experts noted that their companies felt “frozen out” of JCA development and that this was impacting their ability to prepare. Clearly, more needs to be done in this space to prevent the regulatory burden from increasing.

Structure and Governance

The requirement for industry to evolve also represents an exciting opportunity to transform the pharmaceutical organizational model away from being highly oriented to the needs of global, headquarter-centered functions and operations. The current system can limit companies’ flexibility. Where possible and within mutually agreed parameters, giving greater roles to regions enhances their ability to respond to localized access challenges. Regions should be empowered to synergize with affiliates to identify efficiencies and prevent duplication of effort.

- Governance structures: Each organizational level within a hierarchy will become more distinct and work with greater agency. Frameworks for mutual decision making will be required.

- Process: Within organizational levels, fully integrated teams will collaborate on each asset to ensure that launch strategy is more considered throughout drug development.

- Responsibilities: Responsibilities for each division will be unchanged, but interaction between them will start much earlier in asset development.

In this model, while workflows remain largely consistent, communication channels will be more contained within organizational levels and will provide faster answers. This will be critical in coordinating JCA dossier development and managing affiliate alignment to JCA strategy, and it will have positive knock-on effects throughout all regions. With greater autonomy, regions and affiliates will have more agency to ensure that launch efficiency is optimized in each market, because they are closer to the ground. If executed effectively, this separation will free up intellectual resources at the global enterprise level to focus on major decisions relating to drug development and launch.

Market Access is Made More Prominent

Within a fully integrated organizational model, the prominence of each function would not change drastically. Market access is an exception to this. With the IRA and JCA, strategic-level decisions will increasingly be made based on market access pressures, meaning those who understand these pressures will need to be involved. This is a departure from the current situation, where early-stage decision making is siloed to clinical development and regulatory affairs, with market access only becoming involved after asset development has been decided.

Representing market access in the go/no-go development decision will improve the likelihood of profitability throughout the drug life cycle by preventing less promising assets from reaching the market. For instance, the JCA will make single-arm trials a less attractive option due to demands for more robust clinical evidence. In this case, if it is not clear that an asset can demonstrate superior efficacy against an active comparator, market access is likely to push back more strongly against launch than other functions.

Market access not only needs to be a bigger player in decision making, it should also permeate into a wider range of functions. The requirement for more indications to be developed in parallel, imposed by the IRA, combined with increased evidence demands due to the JCA, will encourage market access to interact with bio-stats and medical affairs in a way that is currently absent. The market access perspective will help to filter data communication to the most impactful aspects for asset success. More carefully constructed data packages that provide information which is consistent with asset strategy will be beneficial throughout the value chain.

In this way, market access should become the common thread that is woven through pharma organizations, pulling all functions into closer alignment.

Concluding remarks

The IRA and JCA will introduce a notable perturbation to the pharmaceutical ecosystem. With this will come challenges but also opportunities for the industry to evolve, adapt, and future-proof its operating model. While the precise impact of legislation on profits remains to be seen, the organizational changes outlined here will make companies more financially resilient by ensuring that only assets with sufficient potential reach the market.

A cultural shift towards closer integration will empower regions and affiliates to respond more dynamically to localized challenges. This shift will necessitate increases in competency across the board and an updated organizational structure that supports decentralized decision making.

Crucially, as the stakes are about to become higher, safer bets will have to be made. Market access will have to become central in this transition. In a more prominent position, market access will integrate multiple functions, ensuring that strategies are aligned and execution is cohesive. Overall, companies that choose to embrace this functionally integrated operating model are likely to adapt more quickly and more profitably to the new regulatory environment.

Proactively addressing these issues of culture, capability, capacity, and governance through focused interventions (organizational redesign, training, and focused hiring) is critical to the long-term success of any company looking to launch within the JCA and IRA frameworks.

Please contact us at [email protected] if you wish to hear more about our capabilities in organizational strategy & design, and to find out when and how we can best help with your market access plans, or [email protected] should you want to further explore input for your leadership development and talent acquisition needs.

About the Authors

Luigi Frezza

Managing Director, Global Life Sciences at WittKieffer

With 20 years of experience in executive search, Luigi is expert in working on international recruiting engagements across multiple life sciences functions in Europe and the US — from senior roles in R&D to technical and commercial operations to a broad range of corporate functional roles. Luigi works seamlessly with WittKieffer’s global team to provide exceptional service and to identify life sciences executives who help transform their organizations.

Eddie Gibson

Associate at Wickenstones

Eddie has over 30 years’ experience working across multiple geographies and senior roles within the industry. He has personally led several major European launches and the creation and implementation of global access plans in a wide range of therapy areas including oncology, hematology, virology, neuroscience, cardiovascular disease, and diabetes. This has included leadership of several HTA submissions to NICE, the SMC, and AWMSG across a diverse set of therapy areas as well as serving on the ABPI representation to both the SMC and NICE.

Dingeman Wolfert

Principal and Technical Lead at Wickenstones

Dingeman holds a master’s in international health management from Imperial College London. He is a principal with over 10 years of experience in market access & strategy, developing plans and solutions to support the development and launch of pharmaceutical assets. His experience includes clinical and payer advisory boards, HTA submissions (including PAS schemes), objection handlers, value proposition development, stakeholder engagement strategies, systematic literature reviews, brand management, organizational redesign, healthcare system landscaping, surveys (including BoI studies), and RWE and pricing research. Therapy areas include diabetes, obesity, NASH, oncology, neuromuscular disorders, cystic fibrosis, epilepsy, and rare diseases such as SMA, XLH, SCD, and OI.

Owen Daykin-Pont

Consultant at Wickenstones

Owen has been with Wickenstones for nearly three years, working on a range of access projects including evidence generation, value communication, and early economic modeling. He has BSc in Biomedical Sciences from the University of Manchester, with a year-long industrial placement at Public Health England, Porton Down, contributing to COVID-19 vaccine development.

References

- EFPIA (2024). Guidance needed to ensure EU Joint Clinical Assessment improves patient access to innovative cancer treatments. https://www.efpia.eu/news-events/the-efpia-view/statements-press-releases/guidance-needed-to-ensure-eu-joint-clinical- assessment-improves-patient-access-to-innovative-cancer-treatments/#/.

- Leem & vfa (2022). Leem & vfa joint recommendations for an efficient European Health Technology Assessment. http/leem-vfa-joint-recommendations-eu-hta.pdf.