Disruptive Trends in Healthcare: Unpacking the Evolving Provider Landscape and Opportunities for Growth

- Home

- Insights

- Disruptive Trends in Healthcare: Unpacking the Evolving Provider Landscape and Opportunities for Growth

By Shelly Carolan

Multiple disruptive trends continue to alter the healthcare landscape. This is the first of a four-part series to share our insights into these trends and to identify the leadership qualities, skills and vision required to navigate them. Let’s begin by examining the changing provider landscape: where care is taking place.

Read this article in PDF format.

Setting the Stage

Today’s healthcare provider landscape has evolved dramatically over the years. Services previously delivered only in acute hospitals are now being offered in various settings with hybrid care solutions increasingly at the forefront.

There are many catalysts for this evolution including: value-based care, cost reductions, technological advancements, changing quality metrics and shifting consumer expectations, all of which affect where care is delivered.

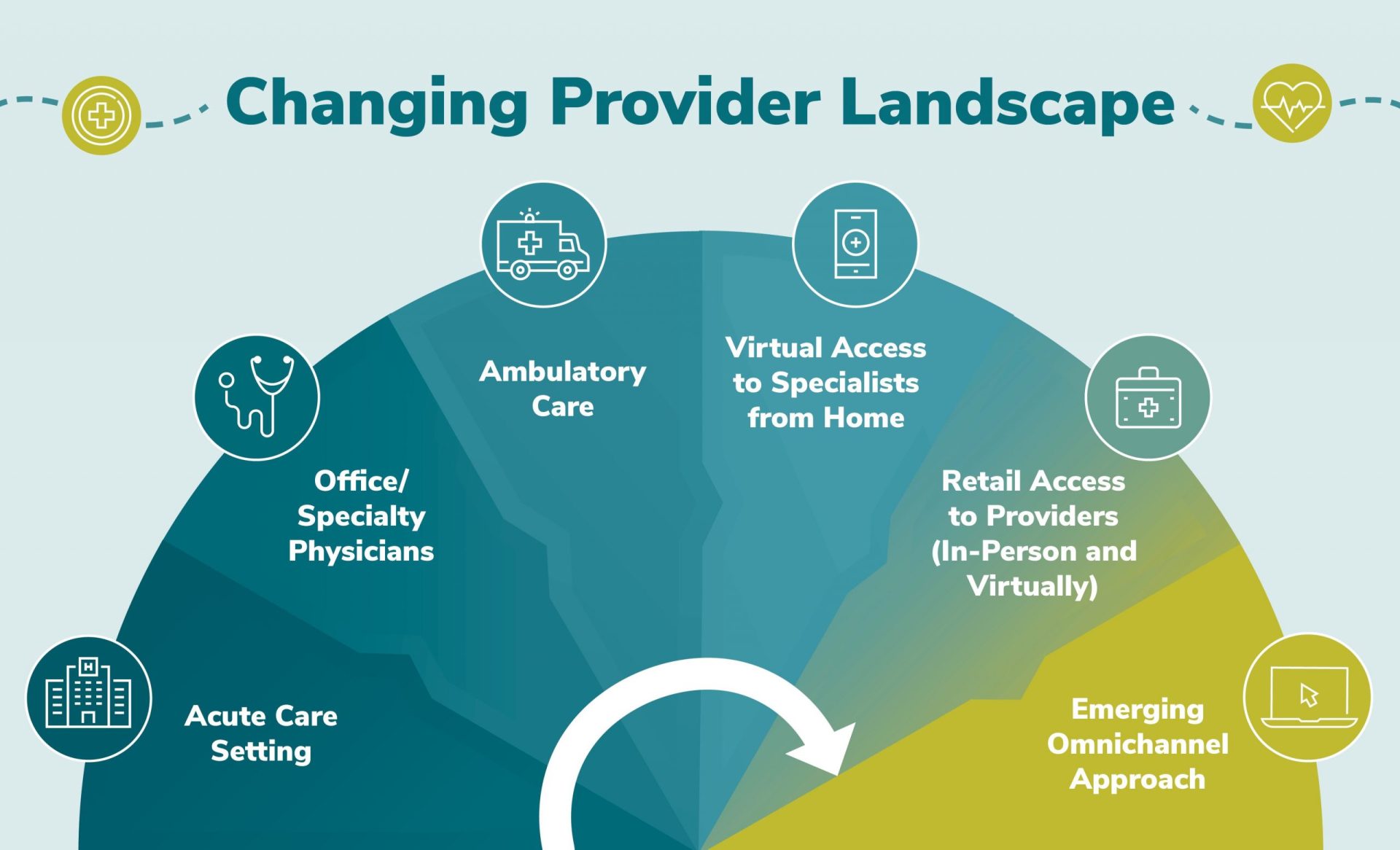

A timeline of the provider landscape evolution – “the where” of care – follows:

- Acute care setting: hospital/institutional settings were initially the only places where interventional and intensive care could be offered, in part due to cost of technology and labor to support that care.

- Office / specialty physicians: advancement in techniques and technologies (and the cost reductions associated) facilitated more distributed diagnostics and interventional care. Value-based care initiatives also recognized that long-stay acute care did not create the best outcomes. As a result, specialty offices and centers became primary points for acute care.

- Ambulatory care: continuing the trend toward distributed care, triage and early interventional care were pushed further to the perimeter, where lower structural costs were met with greater patient access.

- Virtual access to specialists from home: ongoing technological advancements – particularly self-diagnostics, remote monitoring and improved digital communications – now make virtual care viable. The pragmatic urgency of COVID-accelerated adoption significantly shortened the time between early adoption and market acceptance. Today, virtual care is an integral part of the care continuum.

- Retail access to providers (in-person and virtually): despite the accelerated adoption of virtual health, virtual care is not enough to ensure quality of care, consumer education and support, and close integration into that continuum. Furthermore, technology is still not fully accessible or trusted by many population segments. In essence, care at the perimeter still matters. As a result, we are seeing the rise of true retail care, and those retailers are using their scale, their widely distributed points of local presence and technology in tandem to create a new care paradigm.

- Emerging omnichannel approach: omnichannel healthcare delivery, or omnichannel care, refers to delivering health-related services across a spectrum from in-person clinics to digital tools such as virtual care and video or telephonic technologies. In addition, omnichannel or multichannel consumer experience and engagement is rapidly evolving and refers to the various tools used to communicate, educate and interact with healthcare consumers, patients and members. These include traditional mail, email, text messaging, chat apps, website portals and mobile or tablet applications.

What’s Next

Value-based care will continue to have an impact on the provider landscape and on need for increased digitization, data sharing and advanced analytics. With many having experienced telehealth for the first time during the pandemic, consumers of healthcare will accelerate their desire for anytime, anywhere access. This will pressure institutional, group and individual providers to accelerate facility, technology and talent investment in these capabilities.

However, consumerization of care is about more than access. The consumer/patient experience must evolve to integrate the entirety of the health management continuum — namely health and wellness programs, transparent provider pricing and quality comparisons, provider/patient relationship management to promote continuity of care, benefit determination and coordination, and billing and care finance. While experiences are improving around many of these elements individually, they still are widely disparate. To meet the promise of care consumerization, the experience must evolve to be integrated and across systems.

Large health systems may be in the best position to achieve this promise as they already represent the intersection and integration of many points along the healthcare continuum. To this end, we are seeing investment focus among traditional and new entry providers shift from pure consolidation and provider-based vertical integration to enabling technologies that support a consumer-oriented omnichannel care experience. Of note are private equity and venture capital investments by multiple not-for-profit systems, Walmart’s evolved healthcare rollout, Amazon’s acquisition of One Medical, and CVS’s public remarks regarding its own acquisition ambitions.

Together, provider and consumer/patient experiences will impact how healthcare organizations look to create value. The provider landscape is intricate and integrated. Therefore, these shifts have a profound impact across the broader healthcare ecosystem.

Leadership Implications

Healthcare leadership teams will be challenged to evolve to meet the demands of this future landscape. Foundationally, leadership teams and individual leaders must be adaptable, comfortable with ambiguity, growth-oriented, and embody a strategic mindset. New skills, such as those often associated with technology-enabled services (e.g., pricing, customer support, partnering, data management and analytics), will be required to create new business models, processes and infrastructure. Culture must evolve to embrace a diverse, consumer-centric mindset. Lastly, new performance metrics will be required to assess and reward leaders at all levels of the organization.

As investors and healthcare organizations address this future, their strategies should incorporate these leadership implications quickly as a primary focus. They must plan the leadership needs of the future, assess team capabilities and augment them with new leaders possessing the requisite skills. Key to organizations’ future success will be creating the team structures and dynamics to excel and establish the culture that wins in this new and evolving environment.